2024 GTA Housing Market: Monthly Updates (May – August)

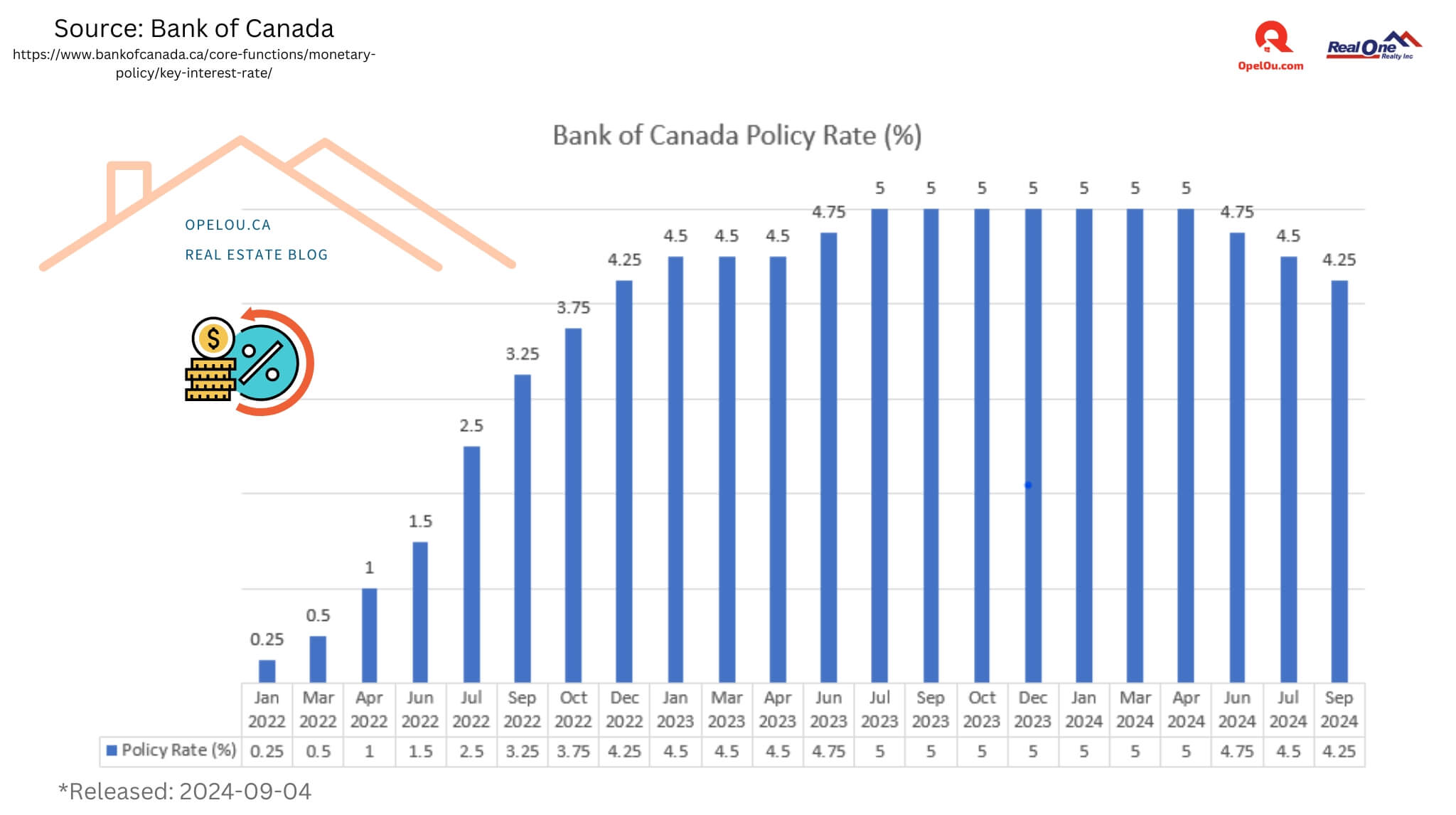

The Greater Toronto Area (GTA) housing market saw notable changes from May to August 2024, as both buyers and sellers adapted to evolving market conditions. Fluctuating mortgage rates, rising listings, and shifting home prices shaped the landscape. Since June 5th, 2024, Canada implemented three consecutive 25 basis point(0.25%) rate cuts with the most recent cut on September 4th. Attention now turns to the U.S. Federal Reserve, with anticipation building for its first expected rate cut on September 18th, which could further influence the market outlook. Below is a breakdown of the key trends for each month.

May 2024: Home Sales Remain Low, New Listings Increase

-Decline in Sales

In May 2024, GTA home sales continued to decline, with 7,013 sales reported, marking a 21.7% drop compared to 8,960 sales in May 2023. This decline reflects ongoing uncertainty in the market, driven largely by high mortgage rates.

-New Listings Show Year-Over-Year Growth

Despite the drop in sales, new listings in the GTA saw a substantial year-over-year increase. In May 2024, 18,612 new listings were added, a 21.1% rise from May 2023. This gave buyers more choices, which in turn led to greater negotiation power on pricing.

-Prices Edge Downward

The MLS® Home Price Index (HPI) Composite benchmark showed a 3.5% decline year-over-year, while the average selling price dropped by 2.5% to $1,165,691 compared to May 2023’s $1,195,409. Despite the drop, prices saw a slight month-over-month increase from April 2024, signaling early signs of stabilization.

-Outlook

TRREB Chief Market Analyst Jason Mercer projected that affordability would improve as mortgage rates trend downward over the next 18 months. However, rising demand could lead to renewed upward pressure on prices as competition among buyers heats up.

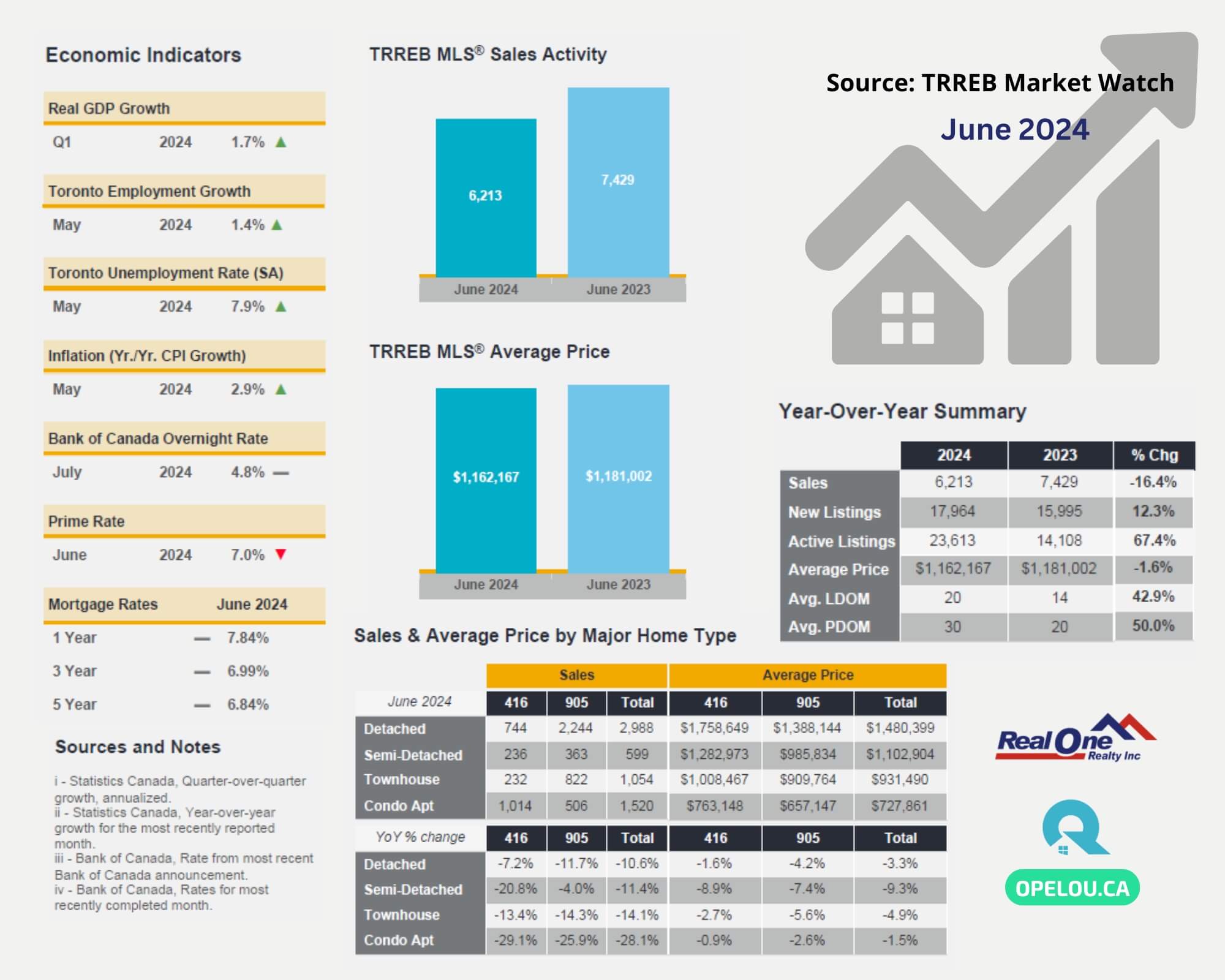

June 2024: Sales Still Sluggish, Inventory Rises

-Fewer Sales Despite Rate Cut

In June 2024, home sales remained lower than expected despite a Bank of Canada rate cut. A total of 6,213 sales were reported in June, down by 16.4% compared to June 2023’s 7,429 sales. Buyers continued to hold off, waiting for additional rate cuts before jumping into the market.

-Inventory Continues to Grow

New listings were up again, with 17,964 new listings, a 12.3% increase over June 2023. The well-supplied market allowed buyers to have more options and stronger negotiating power.

-Prices Decline(AGAIN) But Begin to Stabilize

The average selling price for June 2024 was $1,162,167, down by 1.6% year-over-year. The MLS® HPI Composite benchmark was down by 4.6%, continuing the downward trend from May. However, on a month-over-month basis, both the benchmark and the average price showed slight gains from May 2024, indicating early signs of stabilization.

-Long-Term Outlook

Jason Mercer emphasized that despite current market conditions, the strong population growth in Ontario will drive long-term demand. Continued government intervention and policy changes are necessary to address the housing deficit and ensure adequate supply.

July 2024: Sales Increase, Prices Remain Relatively Stable

-Sales See Modest Year-Over-Year Growth

July 2024 saw a modest 3.3% increase in sales year-over-year, with 5,391 homes sold, compared to 5,220 in July 2023. This uptick was attributed to the Bank of Canada’s rate cuts in June and July, which provided initial relief for homebuyers.

-New Listings Outpace Sales Growth

New listings continued to grow at a faster pace than sales. 16,296 new listings were reported in July 2024, up by 18.5% from July 2023. This surplus in supply kept prices from rising too quickly and gave buyers more negotiation room.

-Prices Edge Lower(AGAIN)

The average selling price for July 2024 was $1,106,617, a 0.9% decrease compared to $1,116,950 in July 2023. However, on a seasonally adjusted basis, the average selling price and the MLS® HPI Composite benchmark were slightly higher than in June, showing some stabilization in pricing.

-Positive Market Signals

As mortgage rates continue to decline, buyers are expected to benefit from lower payments. Although home prices remained relatively flat, the increased inventory will help to moderate price growth in the near term.

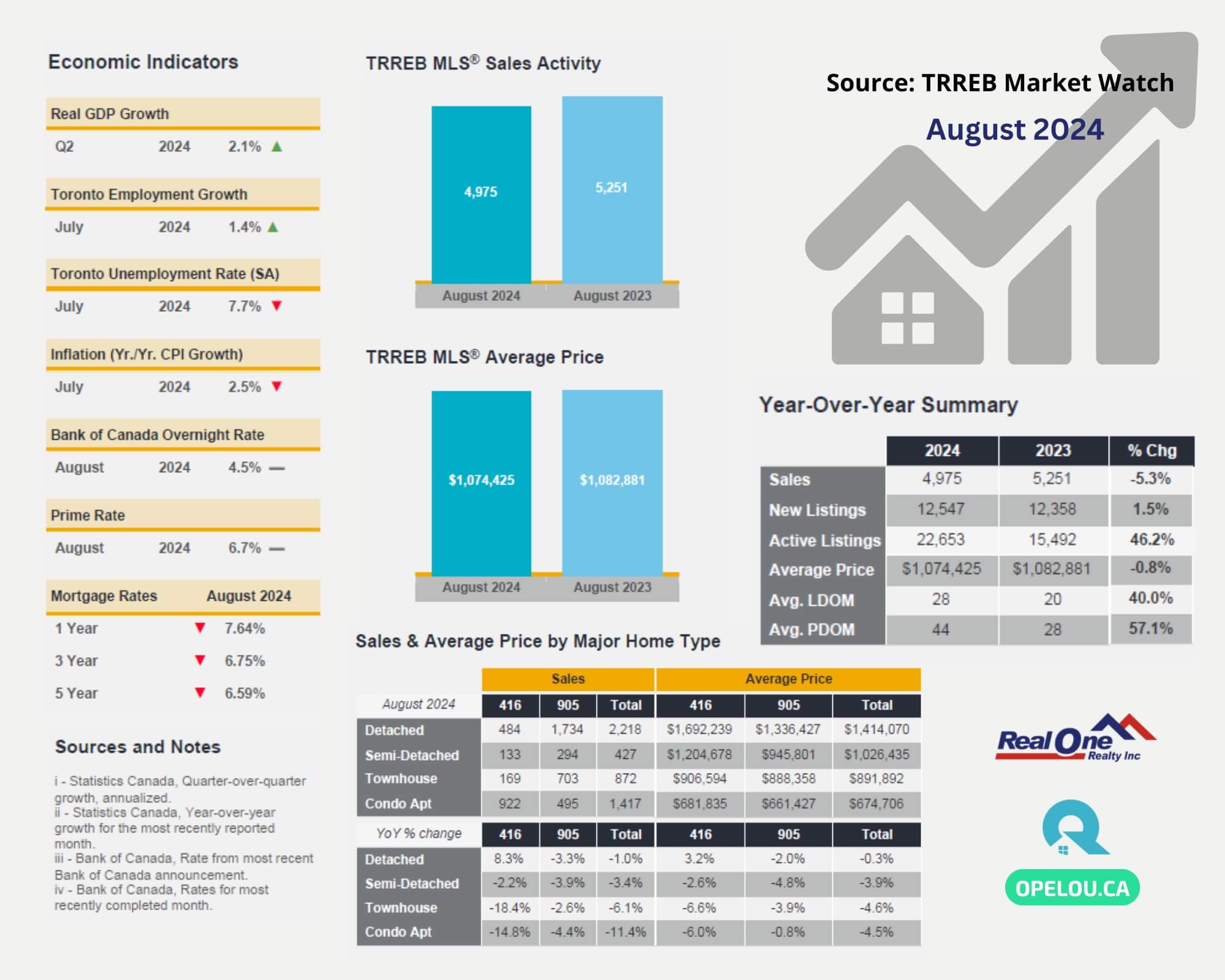

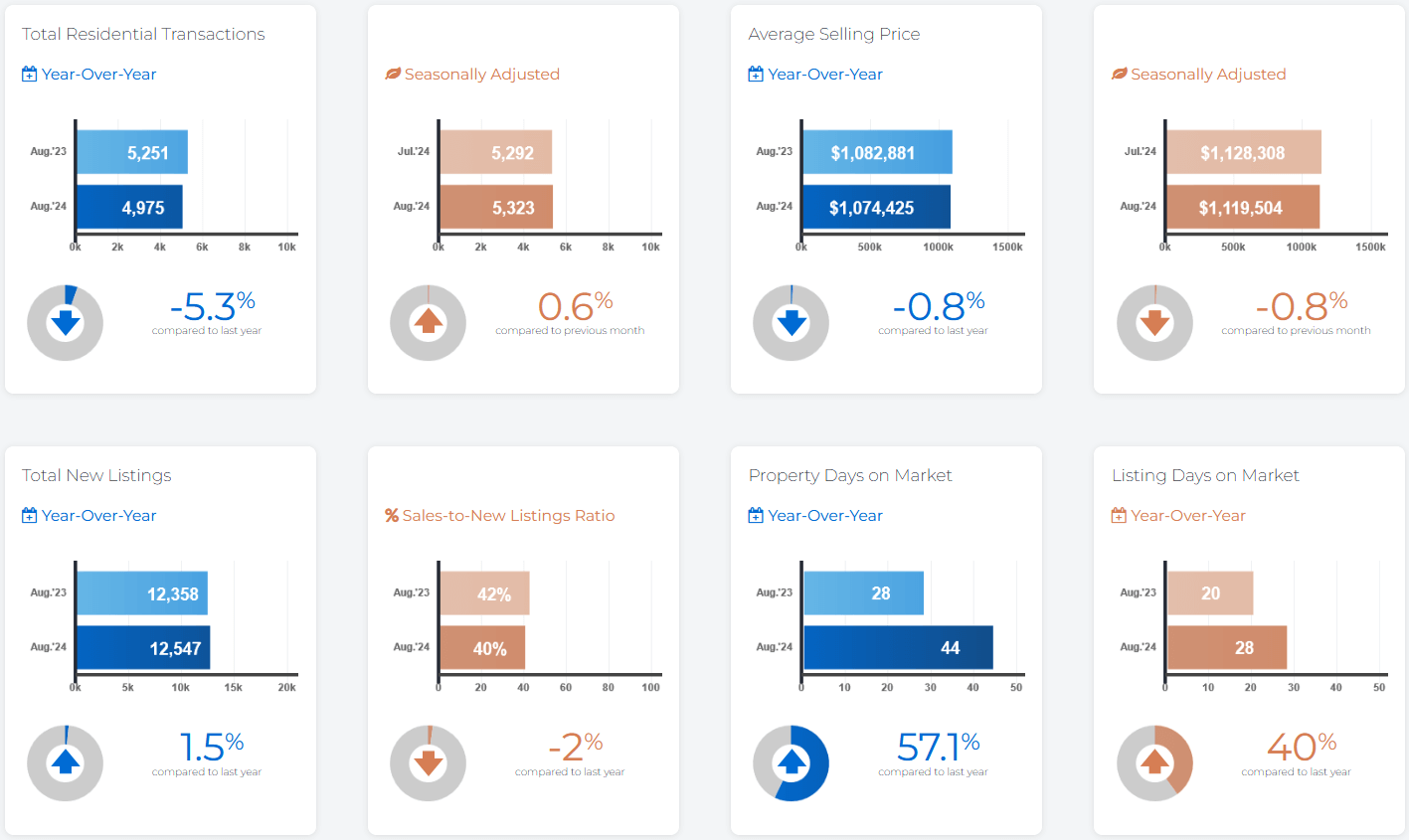

August 2024: Sales Dip, but Inventory Remains Strong

-Sales Decline Again(and AGAIN)

August 2024 saw a 5.3% decrease in home sales, with 4,975 transactions compared to 5,251 in August 2023. Many buyers remained cautious, awaiting further rate cuts before committing to a home purchase.

-New Listings Rise Slightly

New listings in August increased slightly, with 12,547 new listings, up by 1.5% year-over-year. The market continued to offer ample inventory, providing buyers with a range of options to choose from.

-Prices Show Minor Declines

The average selling price in August 2024 was $1,074,425, down by 0.8% from August 2023. The MLS® HPI Composite benchmark declined by 4.6% year-over-year, continuing the trend of price softness. On a month-over-month basis, prices edged slightly lower compared to July.

-Looking Ahead

As the Bank of Canada’s rate cut in early September is expected to further improve affordability, especially for first-time buyers, demand may pick up in the latter half of the year. TRREB Chief Market Analyst Jason Mercer highlighted that although ample inventory is currently available, prices could start to climb again once demand rebounds in 2025.

Key Takeaways

- Sales Decline: Home sales consistently declined from May to August, with year-over-year drops ranging from 5.3%(Aug) to 21.7%(May).

- New Listings Grow: Each month saw an increase in new listings, offering buyers more options and negotiation power.

- Prices Edge Downward: Average selling prices fell year-over-year in all four months, with slight month-over-month stabilization beginning in July and August.

- Outlook: With mortgage rates expected to decrease further, demand may pick up later in 2024, potentially driving prices upward in 2025.

As mortgage rates trend lower and more buyers re-enter the market, the GTA housing market may experience a shift in favor of sellers. However, buyers can still benefit from current inventory levels and moderate prices in the near term.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#GTAHousingMarket #TorontoRealEstate #HousingTrends #MarketUpdate #RealEstateNews #HomePrices #MortgageRates #PropertyMarket #TorontoHomes #RealEstateTrends #Realestatebroker #Realtor #OpelOu

Source: TRREB – Market Watch

August 2024 – Market Statistics – Quick Overview

Residential Statistics

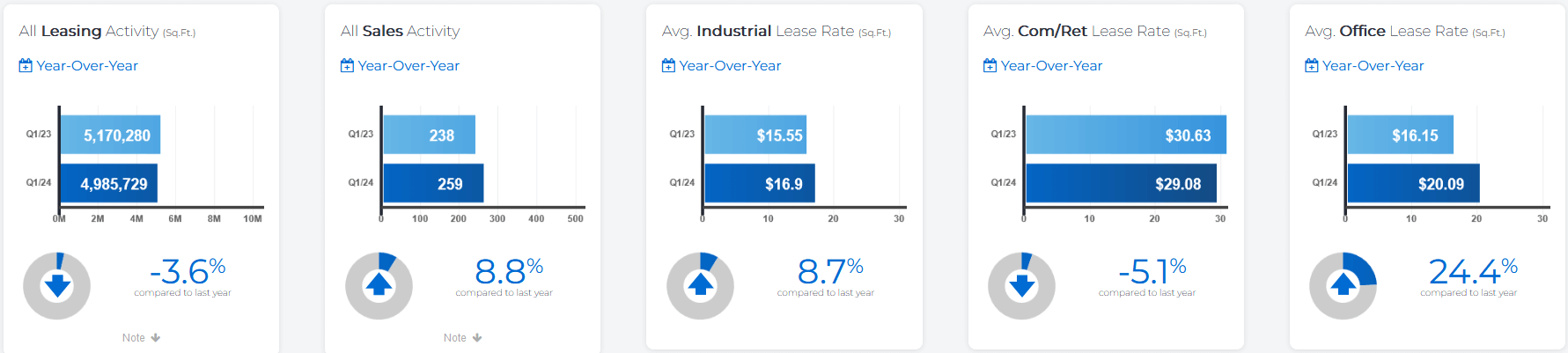

Commercial Statistics(Q1 2024)

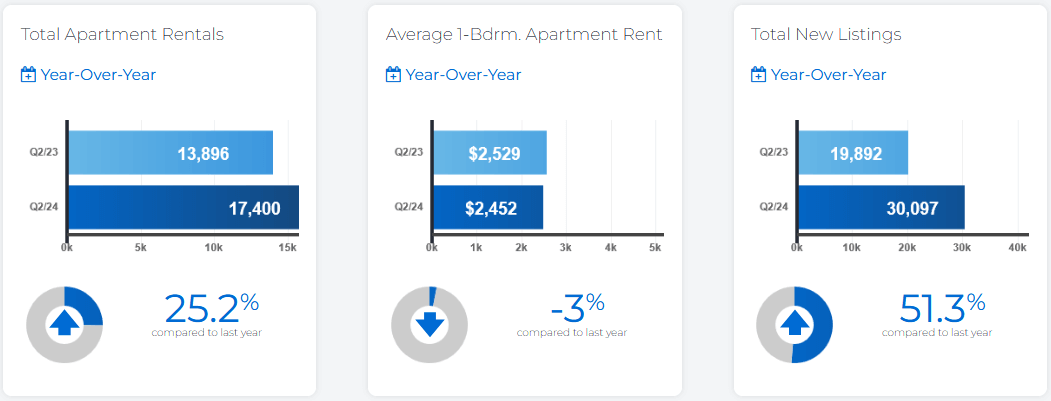

Condominium Rental Statistics(Q2 2024)

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**

Source: Housing Market Chart Archive – The Toronto Regional Real Estate Board (TRREB)