GTA Home Sales Rebound in September 2024: TRREB Market Watch

Home sales in the Greater Toronto Area (GTA) saw a significant boost in September 2024, driven by more affordable market conditions and recent interest rate cuts. As buyers adjusted to changes in mortgage lending guidelines and took advantage of lower borrowing costs, the real estate market displayed promising signs of growth.

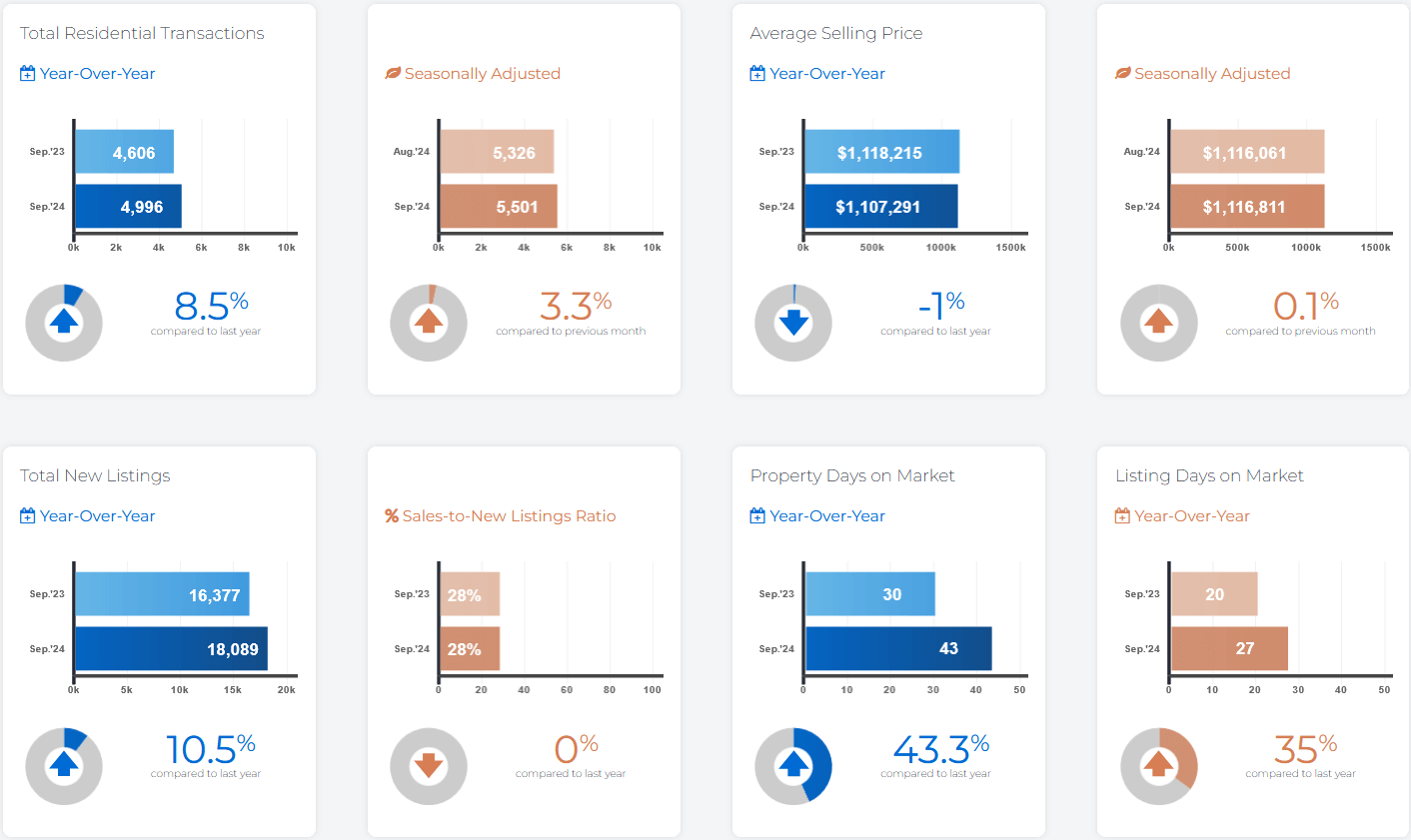

Key Highlights: September 2024 GTA Market

- Total Home Sales: 4,996 homes sold in September 2024, an 8.5% increase compared to 4,606 sales in September 2023.

- New Listings: 18,089 new listings were added, marking a 10.5% rise year-over-year.

- Average Selling Price: The average price of homes in the GTA was $1,107,291, a slight 1% decrease from $1,118,215 in September 2023.

- Home Price Index: The MLS® Home Price Index Composite benchmark fell by 4.6% compared to the previous year.

Understanding the Shift: Why Are Buyers Returning?

According to Toronto Regional Real Estate Board (TRREB) President Jennifer Pearce, the shift is largely due to improved borrowing conditions. As interest rates decrease, more buyers find themselves able to enter the market, making long-term investments in homeownership. These conditions have been particularly beneficial for first-time buyers, who can now better afford the upfront costs associated with purchasing a home.

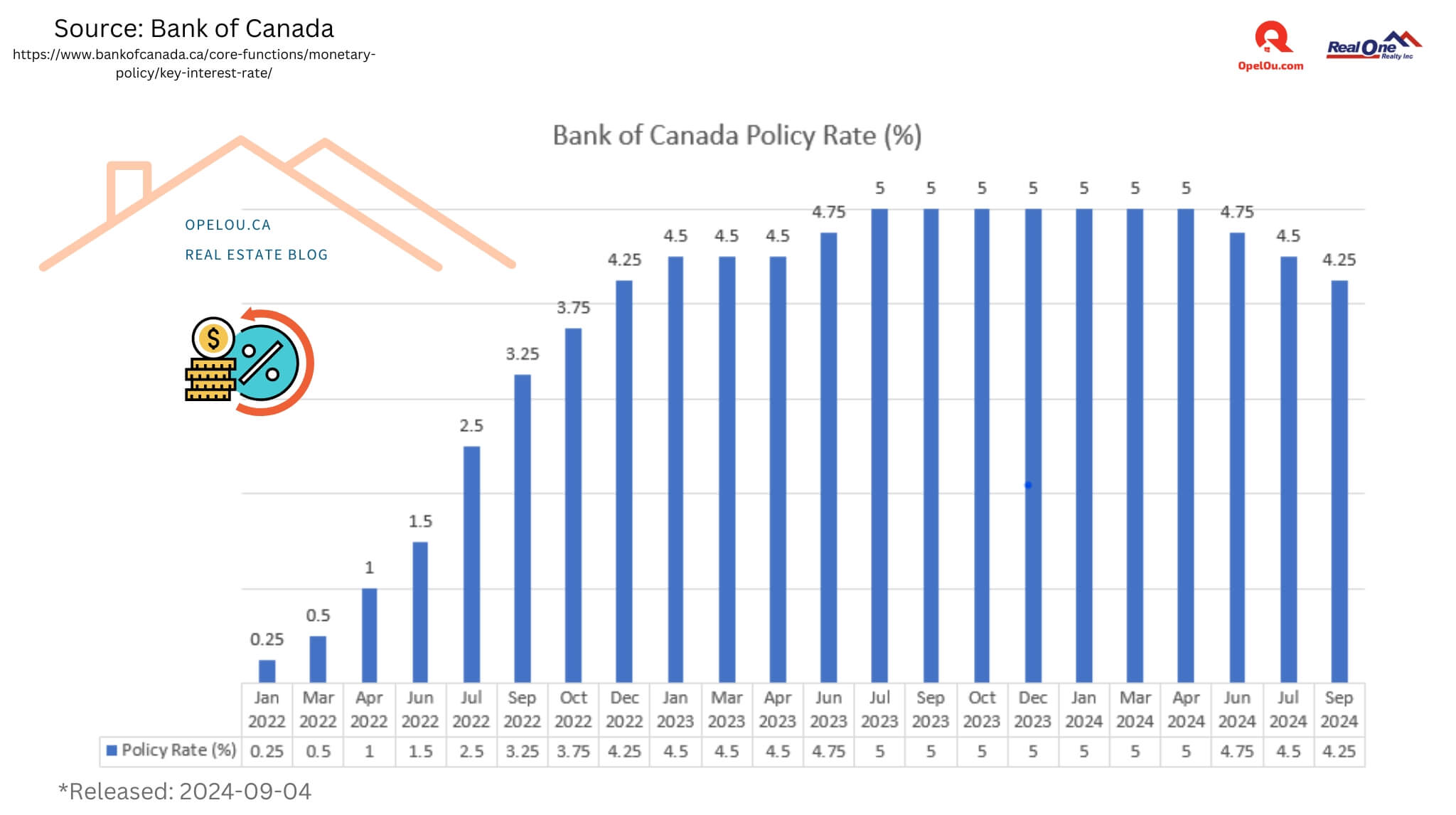

The Role of Interest Rates and Lending Changes

Recent changes to mortgage lending guidelines have made a noticeable impact on the market:

- Lower Interest Rates: With each rate cut, the affordability of mortgage payments improves, encouraging more households to consider buying a home.

- Changes to Mortgage Lending Guidelines: Adjustments like allowing existing mortgage holders to shop around for better rates without the stress test and longer amortization periods are providing buyers with more options.

TRREB CEO John DiMichele noted that these changes give buyers more flexibility, especially in a recovering market, offering the potential for a smoother path to homeownership.

A Market Favoring Buyers

With new listings increasing faster than home sales, buyers have gained greater negotiating power. This means they can secure better deals, particularly in more affordable housing segments like condos and townhouses. TRREB Chief Market Analyst Jason Mercer highlighted that this better-supplied market has contributed to slight declines in prices year-over-year, making it an attractive time for buyers to enter the market.

What Does This Mean for Sellers?

While the increase in listings offers buyers more choices, it also means sellers need to price their homes competitively to attract attention. However, the uptick in sales volume suggests that well-priced homes can still move quickly in this evolving market.

Looking Ahead: Will This Trend Continue?

As population growth in the GTA continues, the demand for housing is expected to remain strong. If borrowing costs continue to trend downward, it’s likely that we’ll see a steady rise in home sales, bringing stability to the market. The recent policy changes in lending are a positive sign for those looking to secure a home, particularly those facing challenges with affordability in the past.

Summary

September 2024 marked a turning point for the GTA real estate market, with home sales rising by 8.5% year-over-year and new listings up by 10.5%. Lower interest rates and changes to mortgage lending guidelines have made homeownership more accessible, especially for first-time buyers. While prices have seen moderate declines, particularly in condos and townhouses, the market is providing opportunities for both buyers and sellers. As lending conditions continue to improve, the GTA market shows promise of steady growth in the coming months.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#GTARealEstate #TRREBInsights #RealEstateTrends #TorontoRealEstate #HomeBuyers #MarketAnalysis #HousingMarket #AffordableHousing #MarketUpdate #HomeSales #MarketOptimism #GovernmentPolicies #PriceAnalysis #InterestRate #TRREBReport #HousingInventory #Homeownership #MarketInsights #TorontoHomes #PropertyMarket #HousingOutlook #BuyerPreferences #FinancialWellness #EconomicResilience #Realestatebroker #Realtor #OpelOu

Source: TRREB – Market Watch

September 2024 – Market Statistics – Quick Overview

Residential Statistics

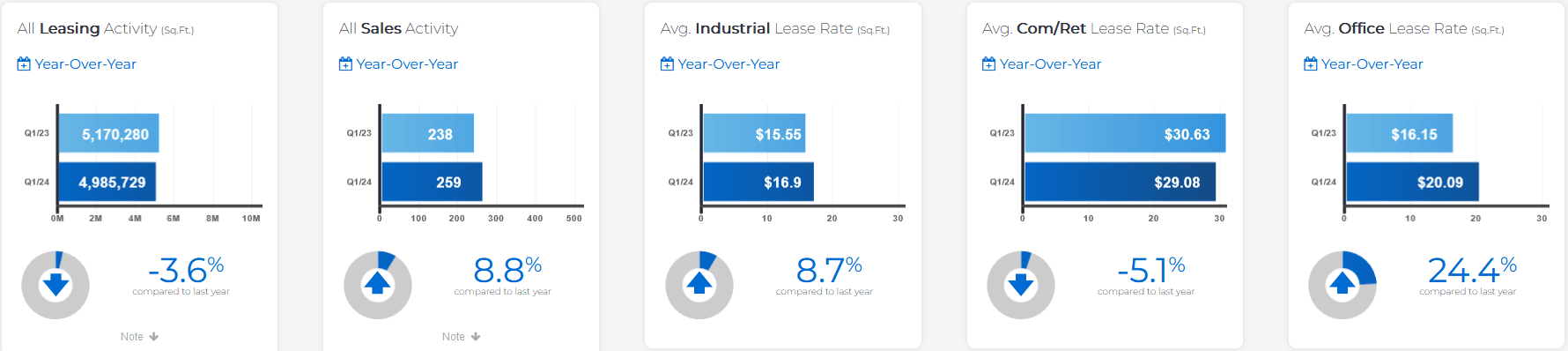

Commercial Statistics(Q1 2024)

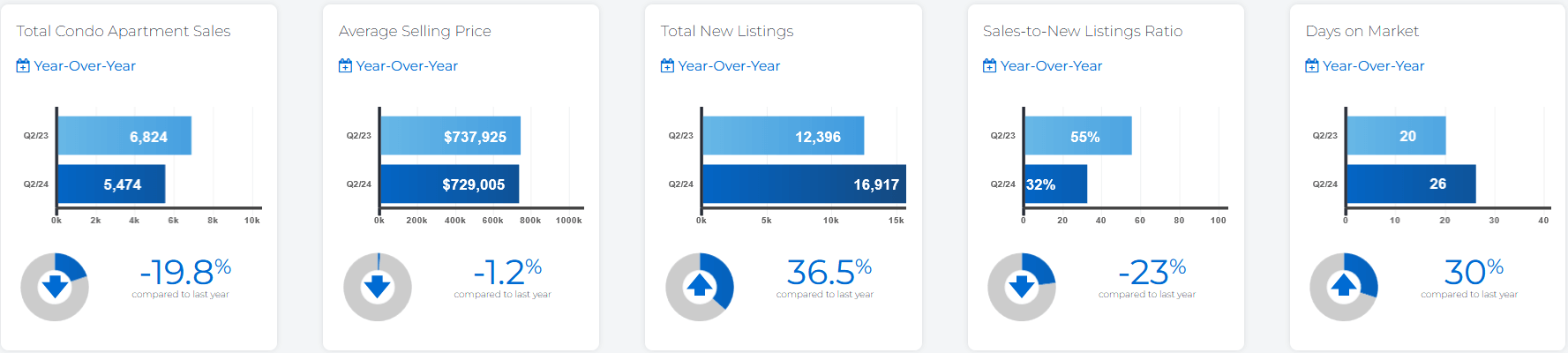

Condominium Sales Statistics(Q2 2024)

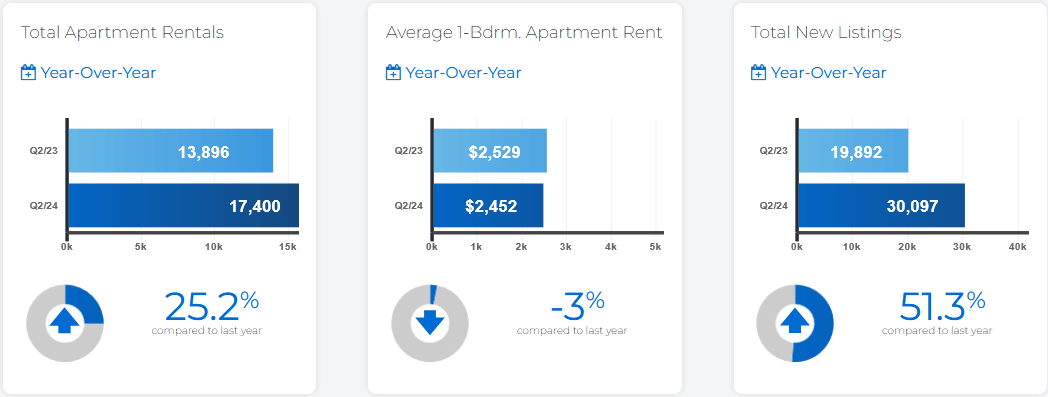

Condominium Rental Statistics(Q2 2024)

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**

Source: Housing Market Chart Archive – The Toronto Regional Real Estate Board (TRREB)