Bank of Canada Holds at 2.75% — Opportunity Knocks for End-User Buyers

🏦 Why the Bank Hit “Pause” Again? — A Signal of Stability

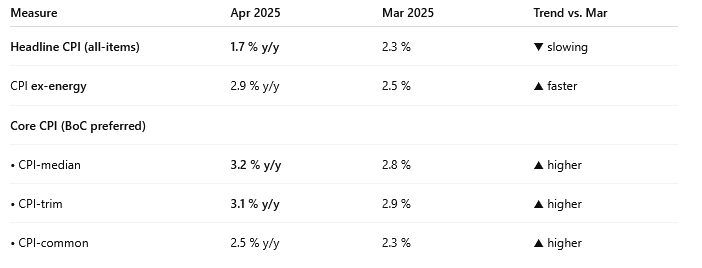

On June 5, 2025, the Bank of Canada held its policy interest rate steady at 2.75% for the fourth consecutive time. While headline inflation has eased to 1.7%, the Bank cited persistent core inflation as the reason for maintaining current rates. Source: Consumer Price Index Statistic Canada

For Canadians thinking about buying a home — especially those planning to live in the property — this decision matters.

🏠 End-User vs. Investor: Who’s Driving the Market? The Market Is Now Favouring End Users

Over the past year, real estate in Ontario has quietly shifted. As borrowing costs remained elevated in 2023–2024, investors have become less active, waiting for rate cuts or more certainty. In their place, end-user buyers — those purchasing homes to live in — are stepping forward.

This shift creates less competition, more listings, and fewer bidding wars across the GTA and beyond.

🔍 Action Plan for 2025 Homebuyers: What This Means If You’re House Hunting Now

Here’s why the current environment might be the right time for you to act:

- ✅ Stable Rates: No surprise hikes mean more predictability in mortgage planning.

- ✅ More Choice: Inventory has risen, giving buyers time to compare and inspect.

- ✅ Reduced Pressure: Fewer bidding wars and investor activity allow more room to negotiate.

- ✅ Long-Term Focus: Today’s buyers are making thoughtful moves — not speculative flips.

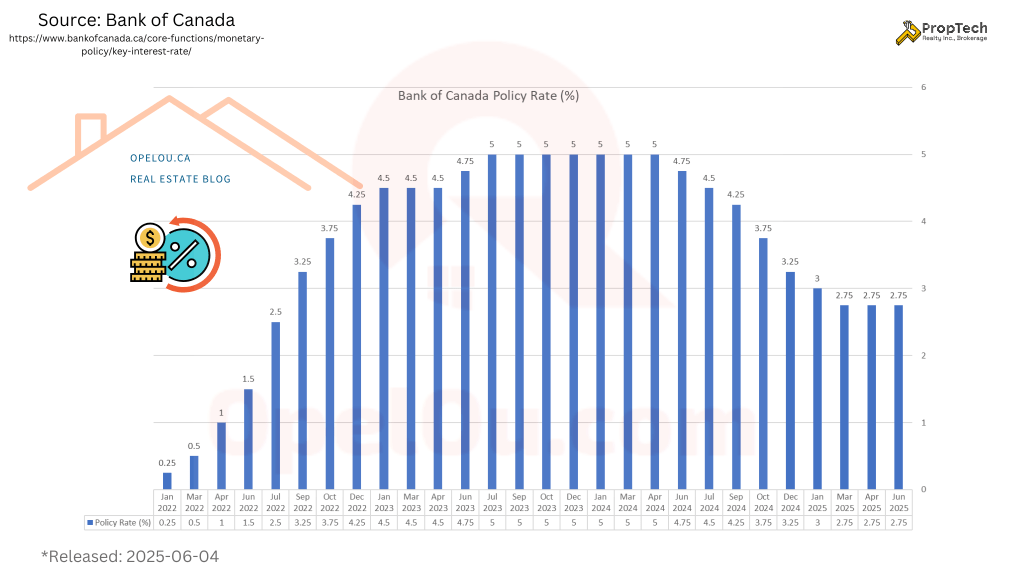

📊 Rate Timeline Recap

This marks four straight meetings where the Bank of Canada has opted for a cautious, steady approach.

🗝️ Final Thoughts: Time Is on Your Side

If you’re planning to move, upgrade, or buy your first home, the current market presents a rare opportunity:

- Less heat.

- More clarity.

- Stronger positioning for smart buyers.

Check out “Why Spring 2025 Is the Smartest Time to Buy?” Blog Post!

Want to explore your next step with confidence? I’m here to help — no pressure, just clear guidance.

📩 Have feedback or questions? Please drop an email to: opel@opelou.com Let’s connect and talk about your strategy.

🖋️ Opel Ou, Real Estate Broker, FRI, SRES

Real Estate made clear, one smart move at a time!

#BankOfCanada #InterestRate2025 #TorontoRealEstate #OntarioHousingMarket #HomeBuyingTips #SmartRealEstateMoves #EndUserMarket #BuyersMarket #GTAHomes #MortgageRateUpdate #RealEstateStrategy #StableRates #MarketShift2025 #RealEstateBroker #Realtor #OpelOu