CPI Up 1.9% in June: How Inflation Affects Ontario Home Prices

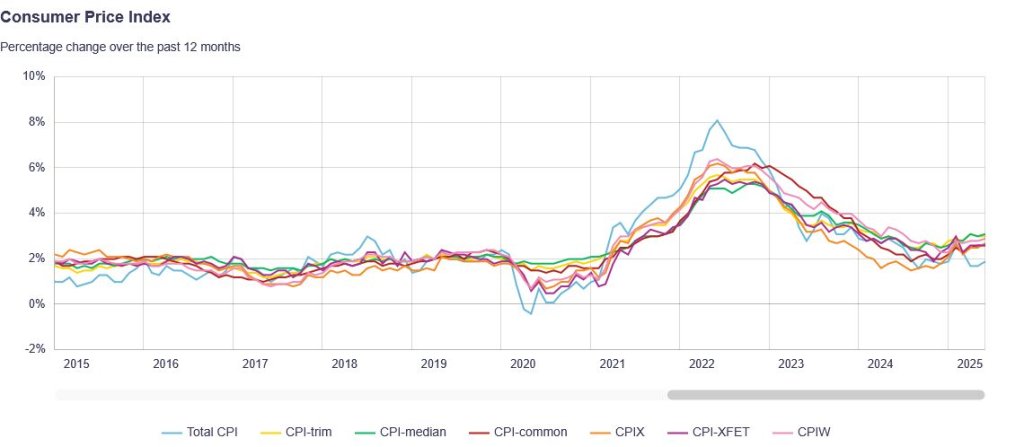

July 2025 saw Canada’s Consumer Price Index (CPI) climb 1.9% year-over-year. With core inflation still above 2.5% and the Bank of Canada holding its overnight rate at 2.75%, Ontario buyers and sellers face critical decisions. In this post, we break down what the data means for borrowing costs, market dynamics and your next move in the Greater Toronto Area.

*Source: Bank of Canada

What the 1.9% CPI Increase Means

- Upward Pressure on Prices: Smaller drops in gasoline and faster growth in durable goods pushed headline CPI from 1.7% in May to 1.9% in June .

- Core Inflation Still Elevated: Excluding energy, prices rose 2.7%, while the BoC’s median CPI hit 3.1%—well above the Bank’s 2% target .

Bank of Canada Rate Decision Impact

On June 4, 2025, the BoC paused at 2.75%, citing persistent core inflation and U.S. trade uncertainty . This pause keeps

- Prime lending rates near 4.95%(as of July 16, 2025)

- 5-year fixed mortgages in the 5–5.5% range as of July 16, at least through summer 2025.

Implications for Ontario Real Estate

1. Borrowing Costs & Affordability

- Uncertain timing of cuts

- After June’s hotter-than-expected 1.9% CPI print, markets pushed back bets on a July rate cut from 27% to just 5% Reuters. Even if the Bank of Canada does ease later in 2025, it’s unlikely to happen before its July 30 meeting—and could slip into autumn.

- Banks may lag on passing cuts

- Historically, lenders don’t immediately lower mortgage rates when the BoC cuts. Buyers could lock at 5–5.5% now, then refinance if—and only if—rates drop meaningfully.

- Budget certainty

- A fixed rate guarantees your payments won’t rise, protecting you against any renewed inflation surprises or global shocks.

- Refinancing flexibility

- Some mortgages allow a one-time refinance or rate “blend & extend” without penalty. Consult your mortgage specialist to find out if it’s possible to lock now, then switch later if cuts arrive.

2. Market Dynamics

- New listings +7.7% YoY in the GTA.

- Average sale prices down 5.4%, to about C$1.10 million .

More inventory means buyers can negotiate extras—think closing credits or renovation allowances. Check out my post on June’s TRREB Market Update!

3. Investor vs. End-User Activity

Persistent inflation and steady rates are deterring short-term speculators, while serious end-users step back in. CMHC data shows purpose-built rental construction remains high, reflecting demand among those delaying purchases .

Outlook & Next Steps

If inflation holds near 2% and core measures stay above target, the BoC will likely maintain a “higher-for-longer” rate posture into late 2025 .

For Buyers

- Lock a 5-year fixed mortgage now to hedge against future rate moves.

- Leverage increased listings: negotiate price, closing costs or upgrades.

For Sellers

- Price strategically based on the neighbourhoods, some more active than others.

- Highlight value-add (e.g., recent renovations, energy-efficient features).

Internal Links:

External Links:

- Bank of Canada rate announcement

- Bank of Canada Daily Digest

- Statistics Canada – June 2025 CPI

- National Bank’s posted rates list

📩 Ready to make a move? Please drop an email to: opel@opelou.com Let’s connect and talk about your strategy.

🖋️ Opel Ou, Real Estate Broker, FRI, SRES, CCGR

Real Estate made clear, one smart move at a time!

- Facebook: https://www.facebook.com/OuRealty

- Instagram: https://www.instagram.com/opeloutorontorealestate/

- Linkedin: https://www.linkedin.com/in/opelou/

#Inflation #CPI #OntarioRealEstate #HousingMarket #MortgageRates #HomePrices #GTAHousing #RealEstateCanada #BankOfCanada #OntarioHousing #GTARealEstate #InterestRates RealEstateNews #PropTechRealty #RealEstateBroker #Realtor #FRI #REIC #SRES #CCGR #CREA #OpelOu