Canada & US Employment Slump Sept 2025 – Rate Cut Ahead for Buyers?

A Shifting Landscape for Homebuyers

The August 2025 TRREB Market Watch highlights a buyer-leaning GTA market—sales are up slightly, listings are growing faster, and prices are down about 5.2% year-over-year, though flat month-over-month. Buyers are getting more choices, but rate movements could tip the balance either way. Check my recent blog post Toronto Housing: Are Prices Near a Floor? TRREB August 2025 Market Watch.

Now, layer on the latest official employment data from Canada and the U.S on September 5th, 2025. It paints a picture of cooling labour markets—with implications for rates, affordability, and demand in our region.

Canada’s Labour Market: Softening Momentum

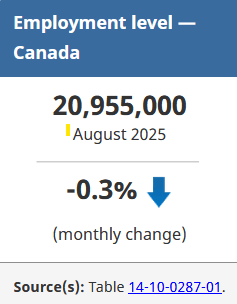

Big monthly job loss and rising unemployment

In August, Canada saw a drop of roughly 66,000 jobs (–0.3%), primarily in part-time roles, pushing the employment rate down to 60.5%

The unemployment rate climbed to 7.1%, the highest non-pandemic level since 2016

Source: Statistics Canada

Industry breakdown…

The hardest-hit sectors were:

- Professional, scientific & technical services: ~–26,100 jobs

- Transportation & warehousing: ~–22,700 jobs

- Manufacturing: ~–19,200 jobs

One bright spot: construction, which added around 17,000 jobs, bucking the broader downward trend.

Wage trends

Average hourly wages rose 3.2% year-over-year to about $36.31, a touch softer than July’s 3.3%, but still a signal of wage persistence.

Source: Statistics Canada – Labour Force Survey

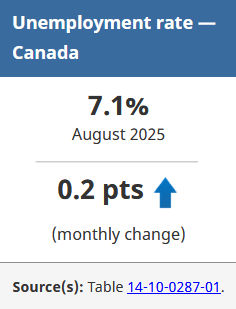

Ontario context

Ontario’s employment fell by approximately 26,000 in August, though interestingly the provincial unemployment rate ticked slightly down (by –0.2 points) to 7.7%, suggesting participation shifts or demographic nuances. Statistic Canada – Map of Unemployment rate by province and territory

U.S. Non-Farm Payroll Snapshot: Stalled Growth

Minimal job gains, steady unemployment

According to the U.S. Bureau of Labor Statistics:

- Non-farm payrolls rose by only 22,000 in August.

- The unemployment rate held at 4.3%—virtually unchanged.

Sector trends

- Health care added jobs (though below its 12-month average).

- Losses occurred in federal government, mining/quarrying/oil & gas, and manufacturing also declined slightly.

Wage growth

Average hourly earnings increased by 0.3% month-over-month, and by 3.7% year-over-year.

Source: Bureau of Labor Statistics

What This Means for Rates and GTA Housing

| Layer | Insight |

|---|---|

| Canada’s labour softness | The sharp job losses and rising unemployment suggest growing economic slack—raising pressure on the Bank of Canada to consider rate cuts. |

| Wage persistence | While wage growth remains moderate, it cushions household income, yet may slow the timing or scale of rate easing. |

| U.S. data | Muted payroll gains and steady unemployment point to cooling without collapse—likely prompting the Federal Reserve to stay accommodative or ease. |

| GTA housing dynamics | Lower rates could soften mortgage costs, increasing demand. But real strength may hinge on job security, especially given part-time and sector-specific challenges. Construction’s strength offers some optimism for localized resilience. |

Internal Link(opelou.ca):

External Links:

- Statistics Canada – Labour Statistics

- Statistics Canada Labour Force Survey, August 2025

- Map of Unemployment rate by province and territory

- US Bureau of Labor Statistics – Employment Situation News Release

📩 Ready to make a move? Please drop an email to: opel@opelou.com Let’s connect and talk about your strategy.

🖋️ Opel Ou, Real Estate Broker, FRI, SRES, CCGR

Real Estate made clear, one smart move at a time!

- Facebook: https://www.facebook.com/OuRealty

- Instagram: https://www.instagram.com/opeloutorontorealestate/

- Linkedin: https://www.linkedin.com/in/opelou/

#CanadaJobs #JobsReport #UnemploymentCanada #BankOfCanada #InterestRates #RateCut #GTAHousing #TorontoRealEstate #TRREB #TorontoHousing #HousingAffordability #MortgageRates #CanadaEconomy #TorontoMarket #GTARealEstate #OntarioHousing #RealEstateToronto #CanadaHousingMarket #USJobsReport #NonFarmPayrolls#PropTechRealty #RealEstateBroker #Realtor #FRI #REIC #SRES #CCGR #CREA #OpelOu