Charting the Path Ahead: TRREB Market Update Chronicles GTA Real Estate from 2023 to the Anticipated Shifts in 2024

2023, A Challenging Year for Home Ownership

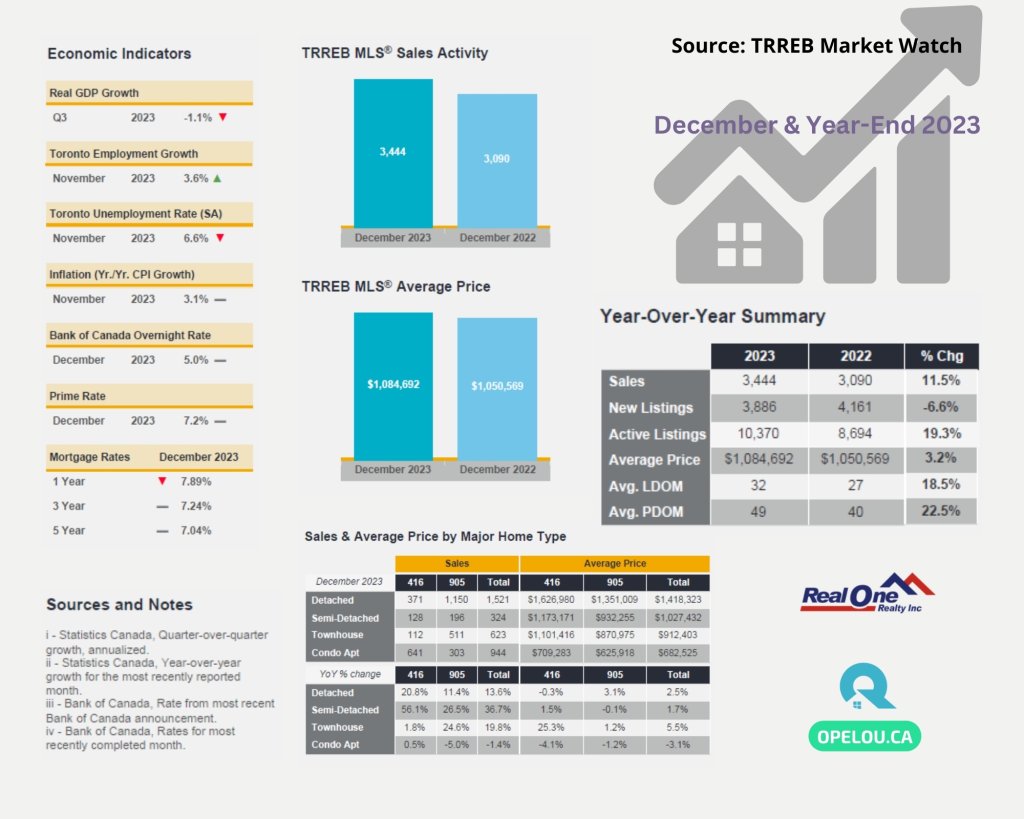

In the wake of the Greater Toronto Area (GTA) real estate market’s performance in 2023, the Toronto Regional Real Estate Board (TRREB) released its December and year-end statistics, revealing a challenging landscape for potential homeowners. Affordability issues, primarily triggered by high mortgage rates, dampened the demand for home ownership, resulting in less than 70,000 home sales throughout the year.

* Demand Shifts to Rentals

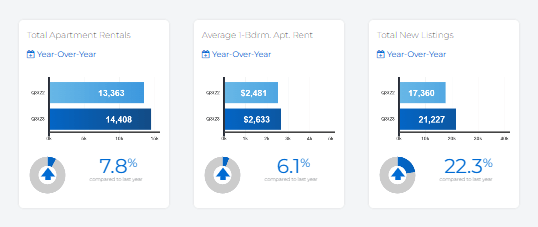

The overall demand for housing remained strong in 2023, fueled by record immigration. However, a significant portion of this demand shifted towards the rental market, as high borrowing costs and stringent federal mortgage qualification standards made home ownership unattainable for many households.

* Affordability Struggles

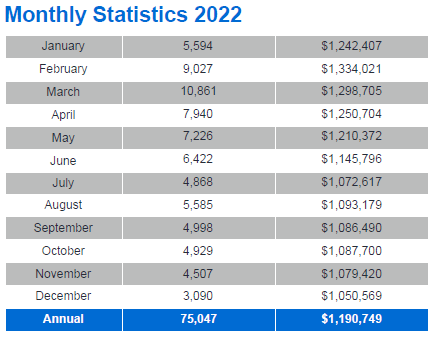

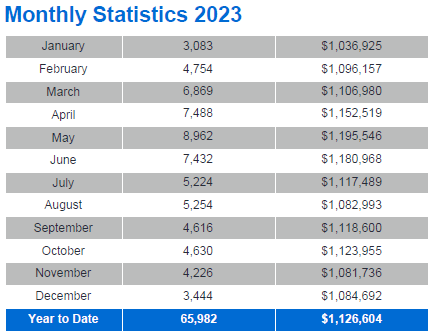

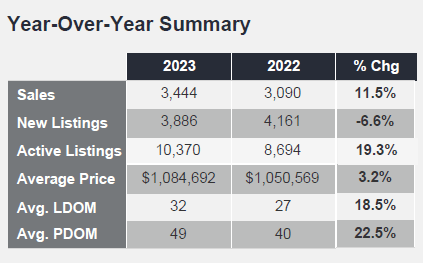

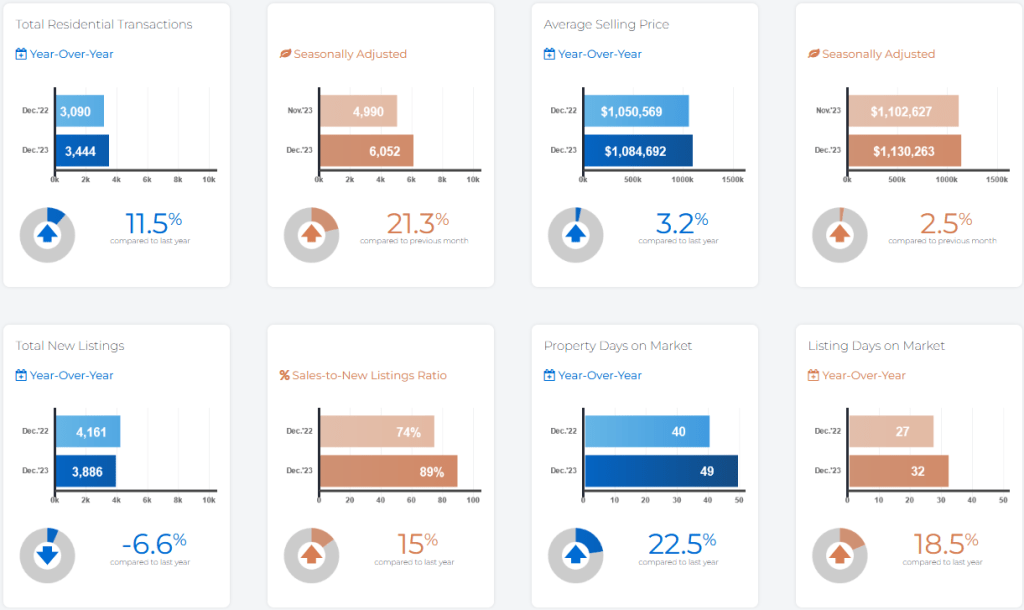

The year 2023 witnessed a 12.1% decrease in home sales compared to 2022, with only 65,982 transactions reported through TRREB’s MLS® System. The root cause of this decline can be traced back to the challenge of affordability. Unrealistic federal mortgage standards and soaring borrowing costs created an unaffordable market for potential home buyers.

Prospects for 2024: A Ray of Hope

Amidst the challenges faced in 2023, there is optimism for the real estate market in 2024. TRREB President Jennifer Pearce anticipates a positive shift, stating, “Borrowing costs are expected to trend lower in 2024. Lower mortgage rates, combined with a resilient economy, should foster a rebound in home sales this year.”

*Decrease in New Listings

Despite an uptick in sales during the spring and summer, the number of new listings declined in 2023. This trend, observed over the past decade, is worrisome considering the steadily growing population. On a seasonally adjusted monthly basis, sales saw a slight increase compared to November, while new listings declined for the third consecutive month.

* Average Selling Price Trends Downward

The average selling price for all home types in 2023 was $1,126,604, reflecting a 5.4% decline from 2022. However, the seasonally adjusted* monthly data shows a slight increase in the average selling price. The MLS® Home Price Index Composite, on the other hand, edged lower. *Seasonality refers to a monthly (or quarterly) pattern that occurs in roughly the same manner from one year to the next, e.g., sales are highest in the spring and lowest in the winter each year.

The Impact on Buyers and Sellers

TRREB Chief Market Analyst Jason Mercer notes that buyers benefited from increased choices in 2023, allowing for negotiation of lower selling prices. As borrowing costs are expected to decrease in 2024, a shift towards tighter market conditions may prompt renewed price growth in the coming months.

* Future Housing Demands and Market Stability

Looking ahead, TRREB CEO John DiMichele emphasizes the importance of addressing the growing demand for homes due to record immigration. He states, “Record immigration into the GTA in the coming years will require a corresponding increase in the number of homes available to rent or purchase.” Ensuring market stability is crucial for individuals to plan their lives with the certainty of having affordable and stable housing options.

Conclusion

while 2023 presented challenges for the GTA real estate market, the anticipated decrease in borrowing costs in 2024 brings a ray of hope for both buyers and sellers. As the market adjusts to these changes, addressing affordability concerns and increasing housing availability will be pivotal for sustaining a healthy real estate environment in the Greater Toronto Area.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#GTAHousing #RealEstateTrends #AffordabilityInsights #AffordableHousing #MarketUpdate #Homebuying #GTAListings #TRREBReport #HomeSales #MarketAnalysis #TRREBInsights #TorontoHomes #HomeBuyers #Homeownership #2023Recap #2024Forecast #Immigration #PropertyMarket #EconomicOutlook #Realestatebroker #Realtor #OpelOu

December 2023 – Market Statistics – Quick Overview

Source: TRREB – Market Watch

Residential Statistics

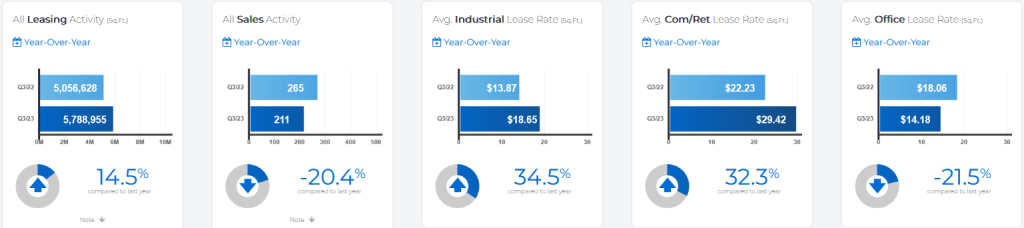

Commercial Statistics

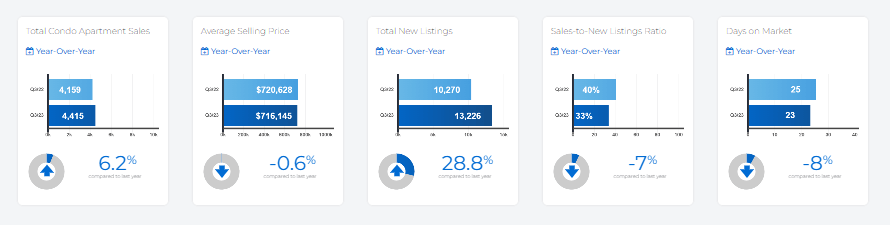

Condominium Sales Statistics

Condominium Rental Statistics

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**