GTA Real Estate Market Update February 2025: High Inventory and Increased Buyer Negotiation Power

Greater Toronto Area Real Estate Market Sees High Listing Inventory

The GTA real estate market in February 2025 provided homebuyers in Toronto and surrounding areas with significant negotiating power due to an increase in available listings. While Toronto home sales declined compared to last year, the high inventory levels allowed buyers more choice, creating favorable conditions for those looking to purchase property in the Greater Toronto Area housing market.

Market Overview: Declining Home Sales, Growing Listings

Toronto Home Sales Drop

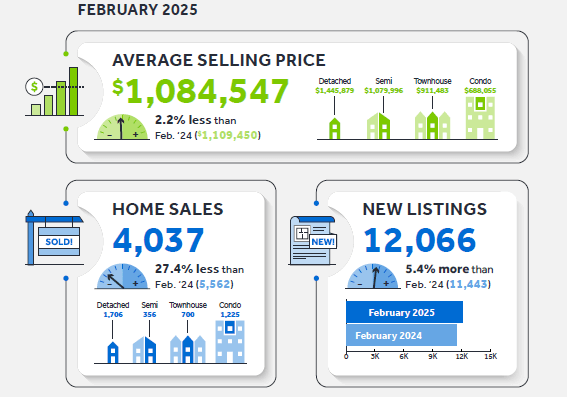

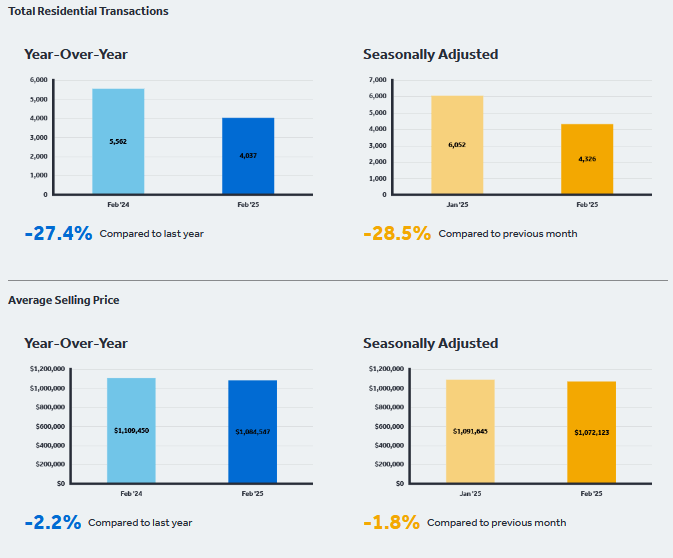

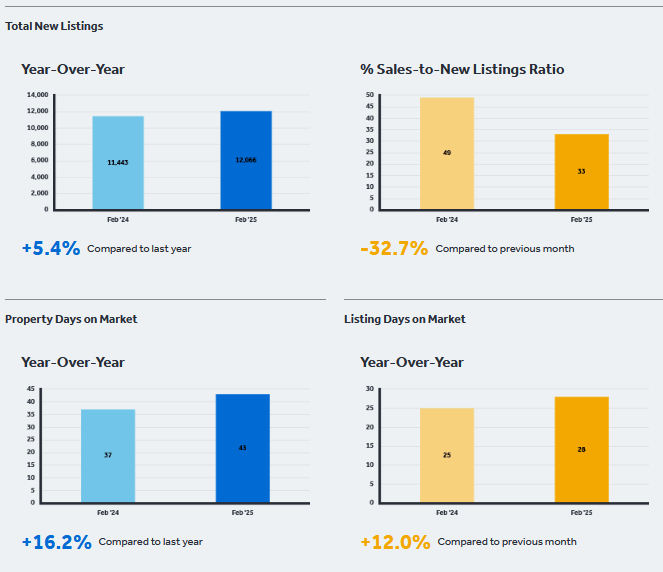

GTA REALTORS® reported 4,037 home sales through TRREB’s MLS® System in February 2025, reflecting a 27.4% decrease compared to February 2024. This drop highlights shifting market conditions as Toronto homebuyers navigate affordability challenges and economic uncertainty.

Rising GTA Real Estate Inventory

At the same time, new home listings in the GTA totaled 12,066, marking a 5.4% increase year-over-year. This increase in inventory gives homebuyers in Toronto more choices and reduces competition, making it easier to secure a property at a reasonable price.

Toronto Real Estate Price Trends: A Slight Decline

Year-over-Year Home Price Changes

The MLS® Home Price Index Composite benchmark saw a 1.8% decline in February 2025 compared to the previous year. The average home price in Toronto also dropped, settling at $1,084,547, a 2.2% decrease from February 2024.

Month-over-Month Price Adjustments

On a seasonally adjusted basis, GTA home prices and the MLS® HPI Composite benchmark edged lower compared to January 2025, indicating continued downward pressure on Toronto property values. This trend benefits homebuyers in Toronto looking for better deals.

Key Economic Factors Impacting Toronto Real Estate

High Mortgage Rates Affect Home Affordability

Despite a strong demand for housing, high mortgage rates in Toronto remain a significant barrier for many potential buyers. However, financial analysts predict a drop in borrowing costs in the coming months, which could improve affordability and boost Toronto home sales.

Economic and Trade Uncertainty Impacts Buyer Confidence

Another factor influencing Toronto’s housing market is economic uncertainty, particularly regarding Canada’s trade relationship with the United States. Many GTA homebuyers are taking a cautious approach, waiting for economic conditions to stabilize before making a purchase.

Housing Policies and Market Outlook for 2025

Government Policy and Housing Affordability

With the Ontario provincial election recently concluded and ongoing shifts at the federal level, housing policy in Toronto remains a key issue. Clear policies on housing supply, affordability, and economic stability will play an essential role in boosting consumer confidence in the Toronto real estate market.

Future Market Predictions

If mortgage rates decrease and economic confidence strengthens, Toronto real estate sales could see a significant rebound in the second half of 2025. Currently, homebuyers in the GTA can take advantage of high inventory levels and better negotiating power before the market potentially shifts again.

Conclusion: Is Now the Right Time to Buy a Home in Toronto?

The GTA housing market is currently in a buyer-friendly phase, offering more choices, lower competition, and potential price reductions. With anticipated improvements in affordability, those considering purchasing a property in Toronto real estate may find favorable conditions before demand picks up again.

Stay Updated on Toronto Real Estate Market Trends

For the latest updates on Toronto home prices, GTA housing inventory, and mortgage rate changes, stay connected with our market insights. Whether you’re buying, selling, or exploring options, staying informed helps you make smarter real estate decisions.

Are you looking to buy or sell in 2025? Reach out today to discuss your options and make the most of the opportunities this market has to offer.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

GTARealEstate #TorontoRealEstate #HomeBuyingTips #TorontoHousingMarket #GTAMarketUpdate #RealEstateInvesting #TorontoHomes #HousingTrends #MortgageRates #FirstTimeHomeBuyer #RealEstateNews #BuyersMarket #TorontoProperty #GTAHomes #HomeAffordability #TRREB #TorontoHomeSales #OntarioRealEstate #HousingMarketUpdate #TorontoCondos #RealEstateBroker #Realtor #OpelOu

Source: TRREB – Market Watch

February 2025 – Market Statistics – Quick Overview

Residential Statistics

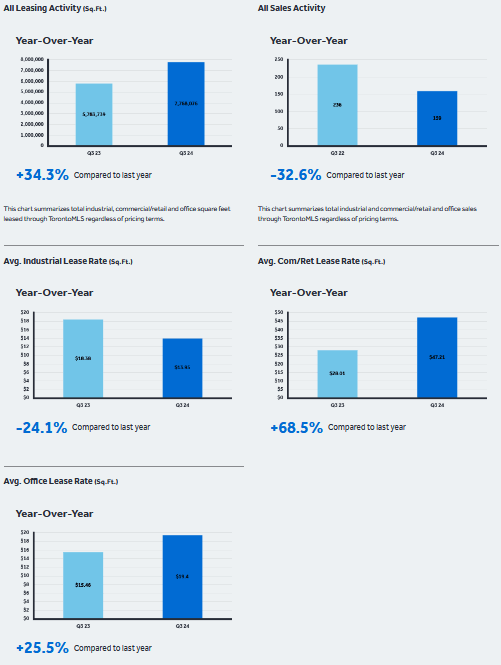

Commercial Statistics(Q3 2024)

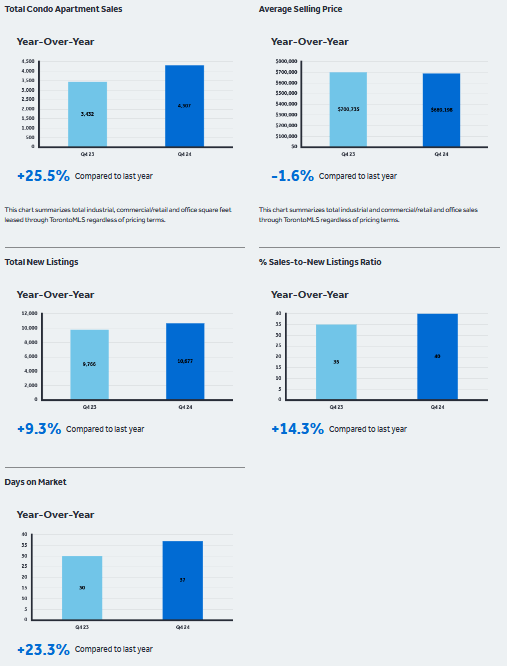

Condominium Sales Statistics(Q4 2024)

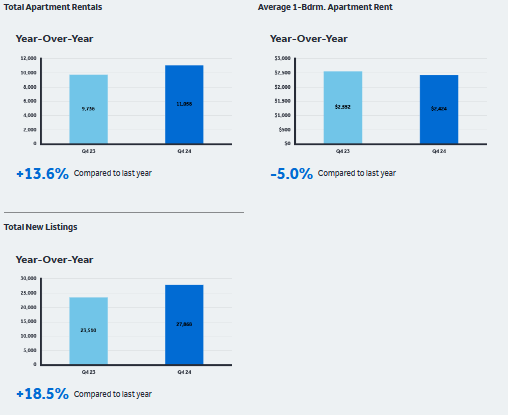

Condominium Rental Statistics(Q4 2024)

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**

Source: Housing Market Chart Archive – The Toronto Regional Real Estate Board (TRREB)