Navigating Affordability, Listings Surge, and Future Harmonies – TRREB Market Update November 2023

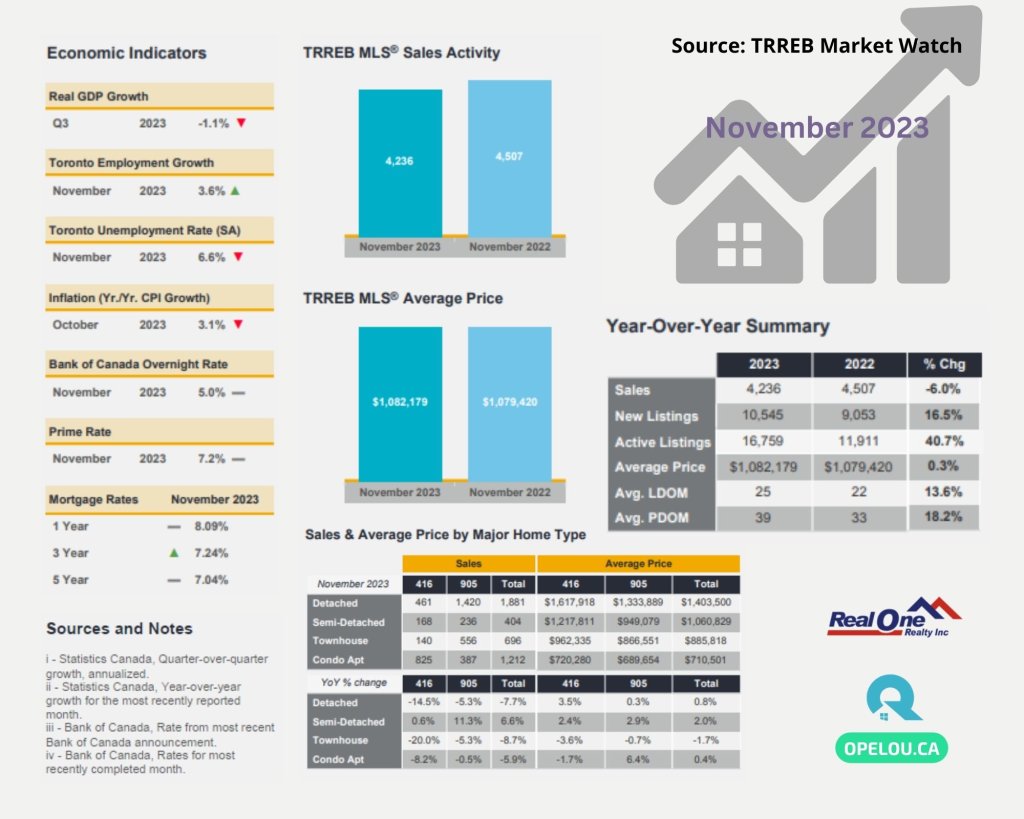

In November 2023, the Greater Toronto Area (GTA) faced the persistent challenges of high borrowing costs and economic uncertainty, significantly impacting the local real estate market. Let’s break down the key statistics and analyze the trends that shaped the month.

Affordability Struggles

Toll on Affordability

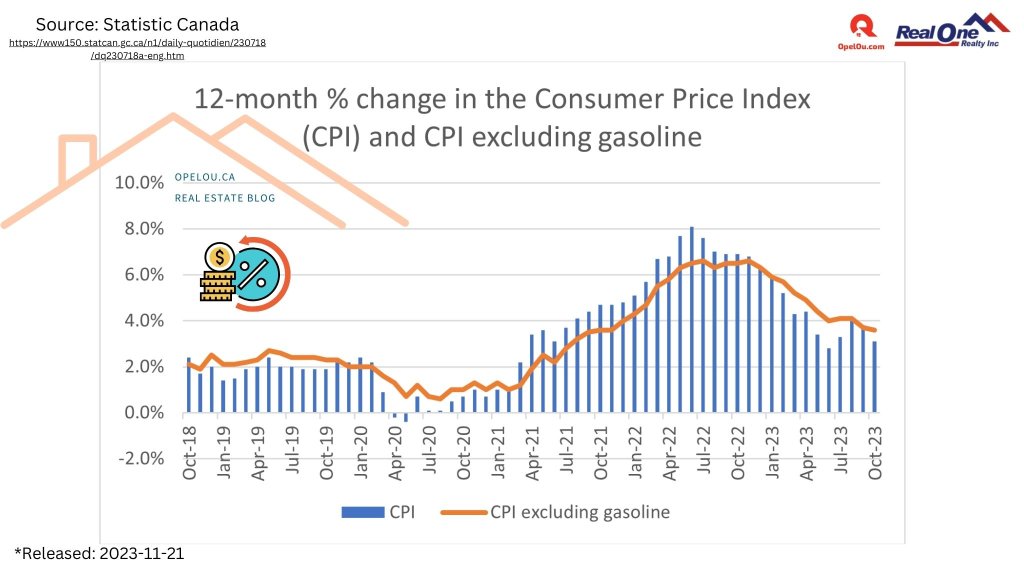

Inflation and heightened borrowing costs have taken a toll on the affordability of homes in the GTA. The housing market, sensitive to interest rates, reflects the struggles faced by potential buyers.

Glimmer of Hope

Amidst the challenges, there’s a glimpse of relief on the horizon. Bond yields, influencing fixed-rate mortgages, are trending lower. Forecasts hint at potential Bank of Canada rate cuts in the first half of 2024, promising to ease affordability concerns.

Sales and Listings Analysis

Year-over-Year Decline

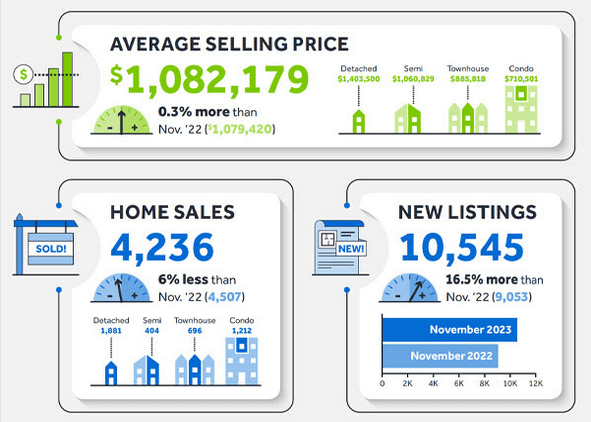

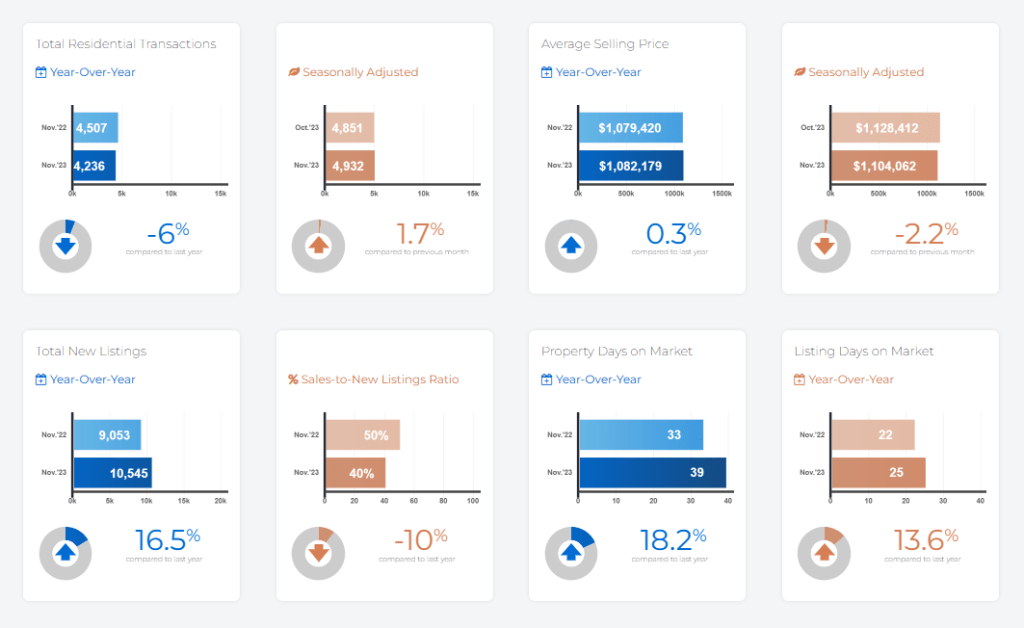

GTA REALTORS® reported a 6 % decline in sales, with 4,236 transactions through TRREB’s MLS® System in November, 2023 compared to the same month in 2022.

Listings Surge

In contrast, new listings saw a substantial increase of 16.5 % compared to the previous year, providing buyers with more choices in the market.

Monthly Adjustments

On a seasonally adjusted monthly basis, sales inched up compared to October 2023, while new listings experienced a 5.5 % decrease.

Price Movements

Price Stability

The MLS® Home Price Index Composite benchmark and the average selling price remained essentially flat at $1,082,179 in November, 2023 compared to the previous year in 2022.

Monthly Fluctuations

On a seasonally adjusted monthly basis, the MLS® HPI Composite benchmark showed a modest decrease of 1.7 %, and the average selling price was down 2.2 % month-over-month.

Future Projections

Adjusted Home Prices

Home prices have adjusted in response to higher borrowing costs, providing some relief for buyers. Anticipated lower mortgage rates in the coming year, coupled with a growing population, are expected to drive renewed growth in home prices.

Policy Initiatives

Recognizing that “houses and condos are meant to be homes, first and foremost”, recent policy decisions aim to enhance housing affordability. These include allowing insured mortgage holders to switch lenders without the stress test. Advocacy continues for similar measures for uninsured mortgages.

Supply Challenges

Acknowledging the demand for homes, both rental and ownership, the need for policy initiatives to bring more supply into the market is emphasized. Further work is deemed necessary to ensure stability and meet the growing demand.

Conclusion

November presented a mixed landscape for the GTA real estate market, with challenges, adjustments, and potential relief on the horizon. The delicate balance between supply, demand, and affordability will continue to shape the future trajectory of the GTA housing market.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#GTAHousing #RealEstateTrends #AffordabilityInsights #ListingSurge #AffordableHousing #NovemberMarketUpdate #Homebuying #GTAListings #TRREBReport #HomeSales #MarketAnalysis #TorontoHomes #FirstTimeBuyers #PropertyMarket #EconomicOutlook #Realestatebroker #Realtor #OpelOu

November 2023 – Market Statistics – Quick Overview

Source: TRREB – Market Watch

Residential Statistics

Commercial Statistics

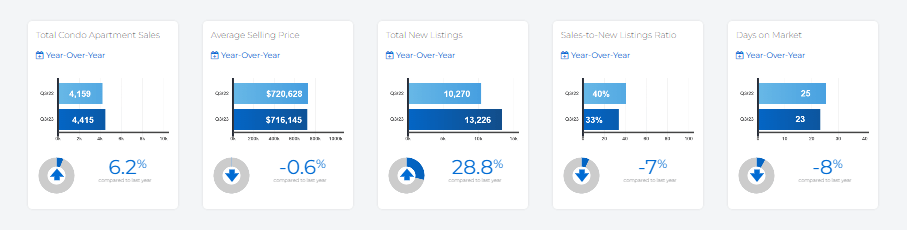

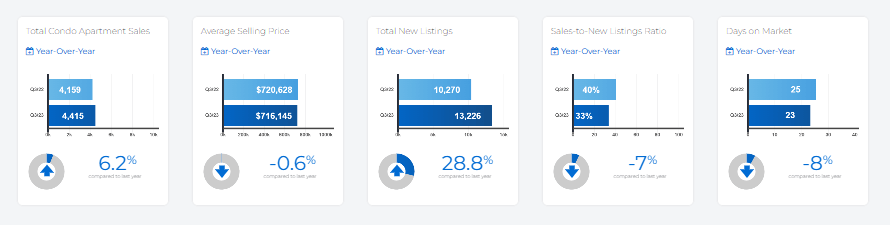

Condominium Sales Statistics

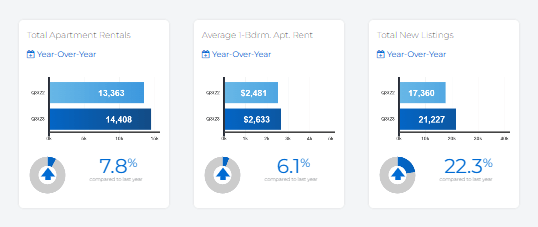

Condominium Rental Statistics

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**