June 2023 Strength and Challenges in GTA Home Sales and Average Selling Price – TRREB Market Update

The real estate market in the Greater Toronto Area (GTA) continues to exhibit positive signs as home sales and average selling prices remained above last year’s levels in June 2023. However, there are factors such as borrowing costs, inventory shortage, and government intervention that are influencing the market. In this blog post, we will analyze the latest data provided by the Toronto Regional Real Estate Board (TRREB) and explore the implications for potential home buyers & sellers and the overall housing market.

Strong Demand for Ownership Housing

Despite higher borrowing costs, the demand for homeownership in the GTA has remained strong, surpassing last year’s levels. The Toronto Regional Real Estate Board (TRREB) President, Paul Baron, highlighted the fact that home sales were affected by uncertainty surrounding inflation and interest rates set by the Bank of Canada. Additionally, a lack of available inventory has made it difficult for some potential buyers to find a suitable home.

Sales Performance

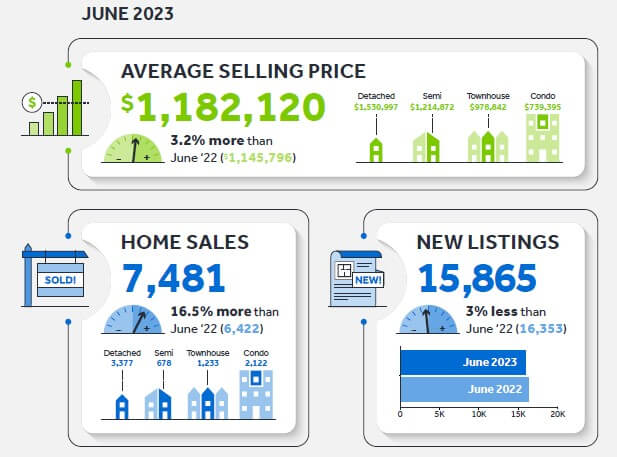

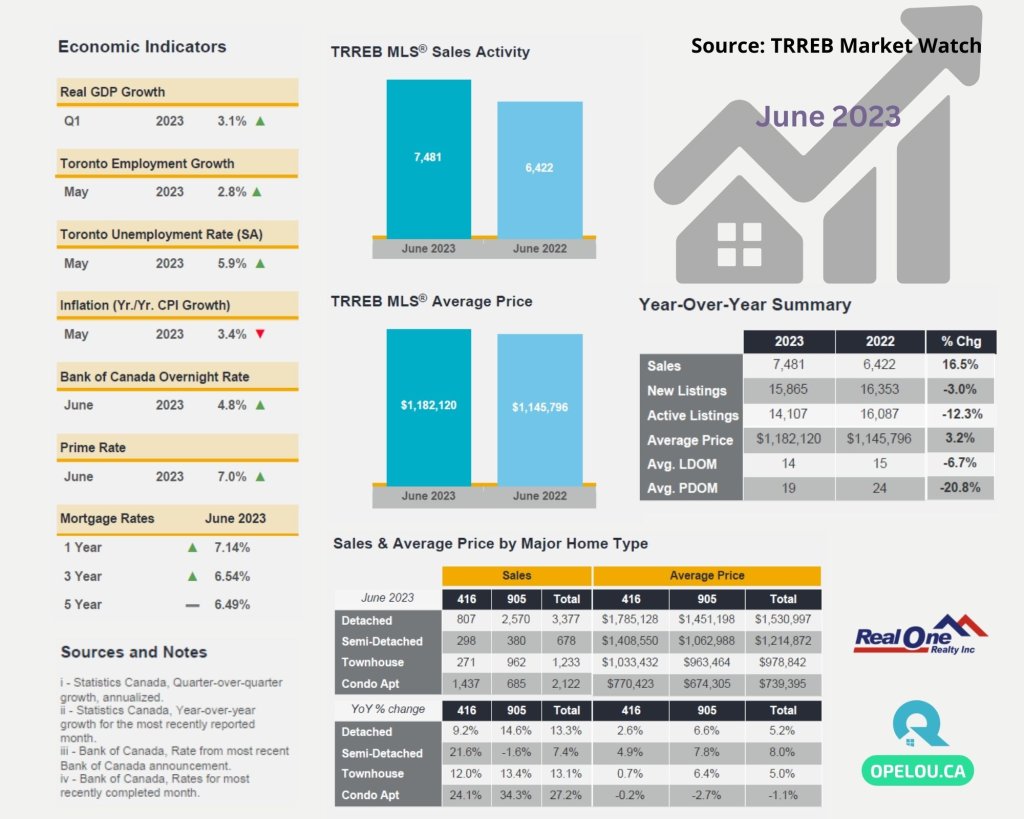

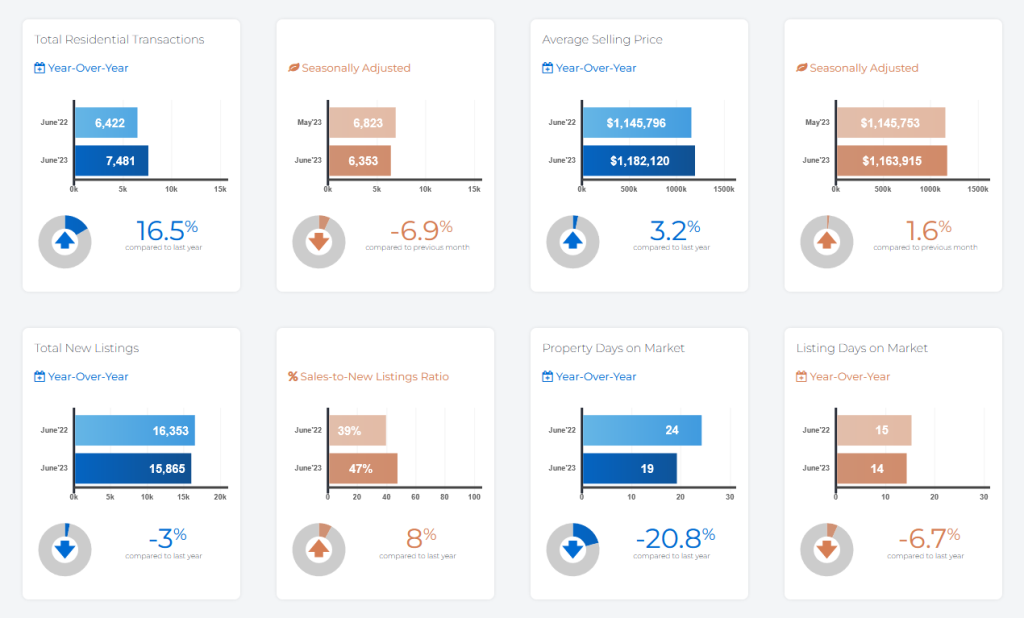

GTA REALTORS® reported 7,481 sales through TRREB’s MLS® System in June 2023, marking a 16.5% increase compared to June 2022. However, the number of new listings decreased by three percent during the same period, resulting in tighter market conditions in June 2023 compared to the previous year.

Average Selling Price

The average selling price for homes in the GTA rose by 3.2% to $1,182,120 in June 2023. Although the MLS® Home Price Index (HPI) Composite benchmark still showed a 1.9% decline compared to the previous year, this decline represents the lowest annual rate of decrease in 2023. On a month-over-month basis, both the seasonally adjusted average selling price and the MLS® HPI Composite benchmark increased. Click here to see the quick overview from TRREB website.

Factors Influencing the Market

TRREB Chief Market Analyst, Jason Mercer, attributed the robust home sales to the resilient economy, a tight labor market, and record population growth in the GTA. Looking ahead, the decisions made by the Bank of Canada regarding interest rates and inflation will significantly impact the housing market’s recovery.

Housing Supply and Affordability Concerns

GTA municipalities continue to struggle to keep up with the growing demand for housing. The deficit in available listings, combined with record population growth, is exacerbating the housing supply crisis. TRREB CEO John DiMichele emphasized the urgent need for government leaders to address this issue promptly. Additionally, housing affordability remains a concern due to taxation and fees associated with home sales and construction, as well as the general level of taxation impacting households.

Summary

The real estate market in the Greater Toronto Area (GTA) showed resilience in June 2023, with home sales surpassing last year’s levels and the average selling price continuing its upward trend. However, challenges such as borrowing costs, inventory shortages, and housing affordability persist. It remains to be seen how the decisions made by the Bank of Canada and government interventions will shape the future of the housing market in the GTA.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#TRREB #Marketupdate #GTAhousingmarket #TorontoRealEstate #GTARealEstate #HousingMarketTrends #TorontoHousing #SupplyShortage #DemandVsSupply #Homebuyers #AffordableHousing #SeasonalAdjust #HousingMarket2023 #RealEstateNews #GTAPropertyMarket #HousingAffordability #HomeOwnership #OpelOu #RealestateBroker #Realtor

June 2023 – Market Statistics – Quick Overview

Residential Statistics

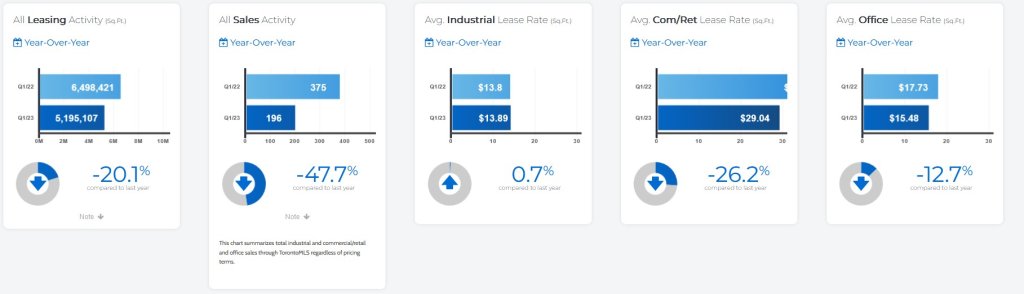

Commercial Statistics

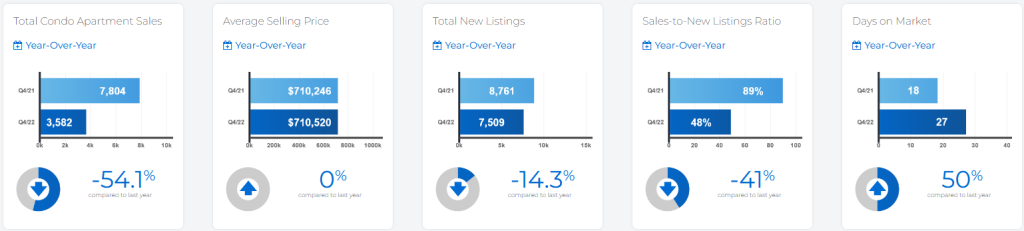

Condominium Sales Statistics

Condominium Rental Statistics

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**