TRREB Market Watch: 2025 Outlook and January Stats

A Steady Year Ahead for GTA Real Estate

The Toronto Regional Real Estate Board (TRREB) has released its 2025 Market Outlook and Year in Review, highlighting a year of steady home price growth in line with inflation. With an anticipated increase in transactions, a well-supplied housing market, and lower borrowing costs, the Greater Toronto Area (GTA) real estate market is expected to remain stable throughout the year.

Key Market Predictions for 2025

According to TRREB, the 2025 housing market will see:

- 76,000 home sales, marking a 12.4% increase from 2024.

- An average home price of $1,147,000, reflecting a 2.6% rise compared to last year.

- Stronger price growth for single-family homes, while the condo market remains well-supplied and more balanced.

Why Are Home Sales Expected to Rise?

The primary driver behind increased home sales is the expectation of lower mortgage rates. As borrowing becomes more affordable, many buyers who previously waited on the sidelines may re-enter the market. However, economic uncertainties, including potential trade disruptions, could temporarily impact consumer confidence and spending power.

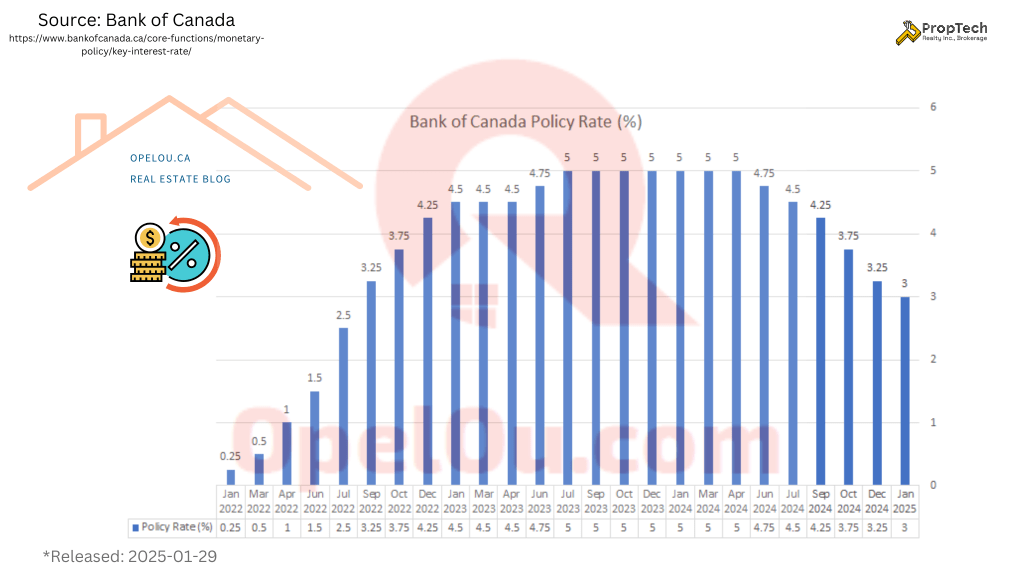

Impact of the Bank of Canada Rate Cut

In early 2025, the Bank of Canada implemented a rate cut, reducing its benchmark interest rate to support economic growth. This move has direct implications for the GTA housing market:

- Lower mortgage rates: Homebuyers can access more affordable financing, making it easier to qualify for loans and reducing monthly mortgage payments.

- Increased buyer activity: With borrowing costs declining, more buyers are expected to enter the market, leading to heightened competition for desirable properties.

- Price stabilization: While demand is set to increase, a well-supplied market should prevent runaway price spikes, keeping growth moderate and predictable.

- Boost to investor confidence: Lower interest rates make real estate investments more attractive, potentially increasing demand for rental and multi-unit properties.

As a result, the GTA real estate market is likely to experience steady price appreciation, but without the extreme volatility seen in past boom-and-bust cycles.

Housing Supply and Market Affordability

TRREB emphasizes the importance of housing diversity and an improved supply to address affordability challenges.

- Missing-middle housing (townhomes, duplexes, and low-rise multi-unit buildings) is crucial for increasing attainable homeownership options.

- Purpose-built rentals continue to be a necessary solution to ensure long-term housing security.

- Development charges and taxes remain a significant hurdle, contributing to affordability issues and slowing down much-needed housing projects.

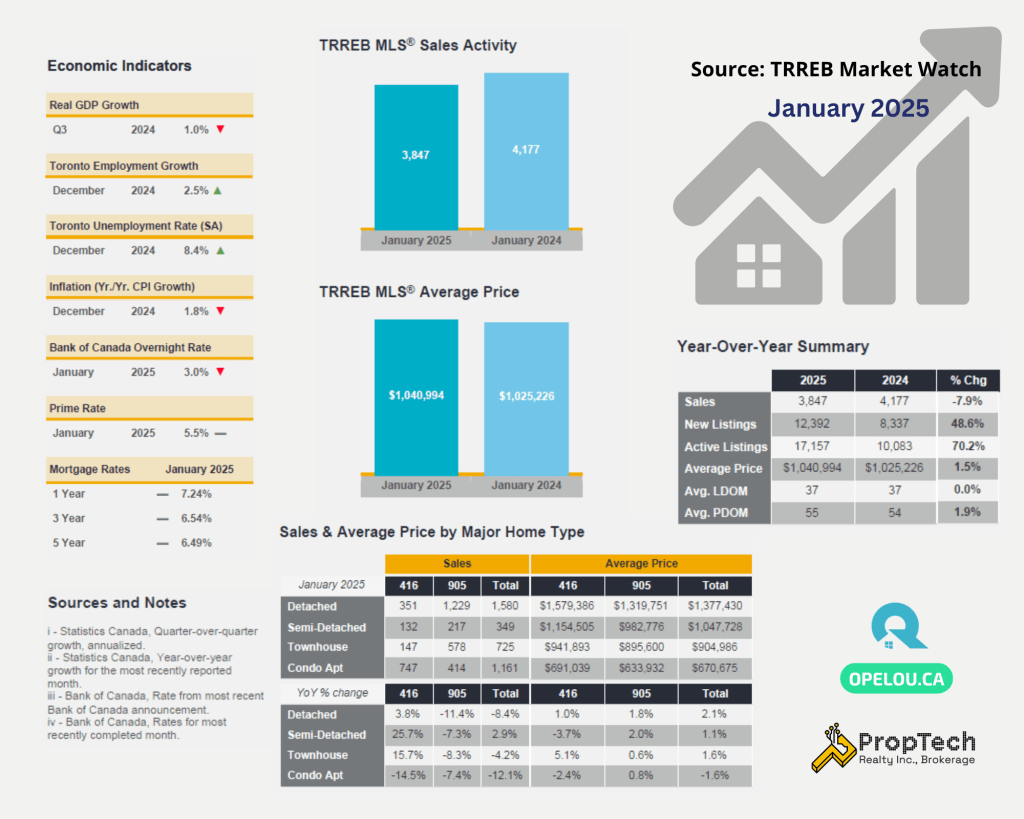

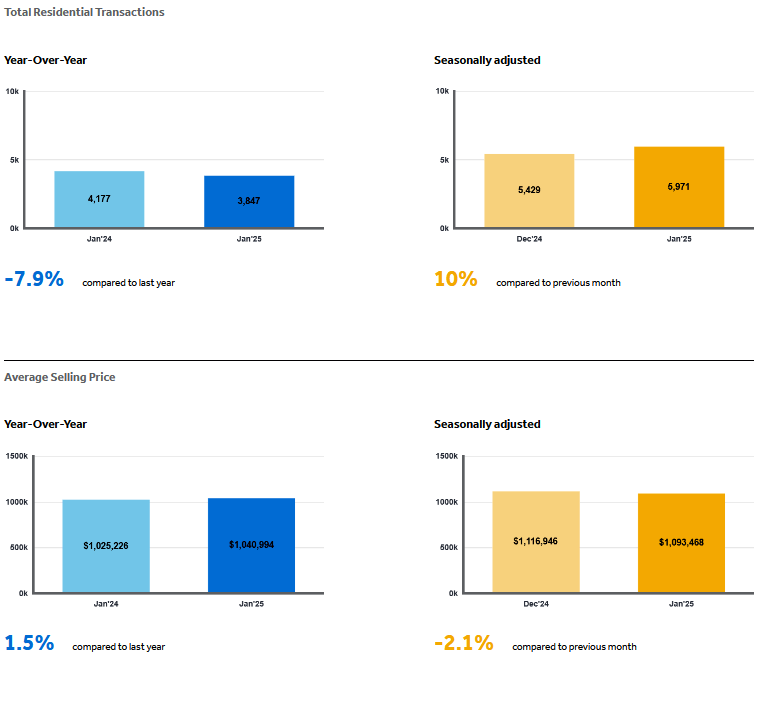

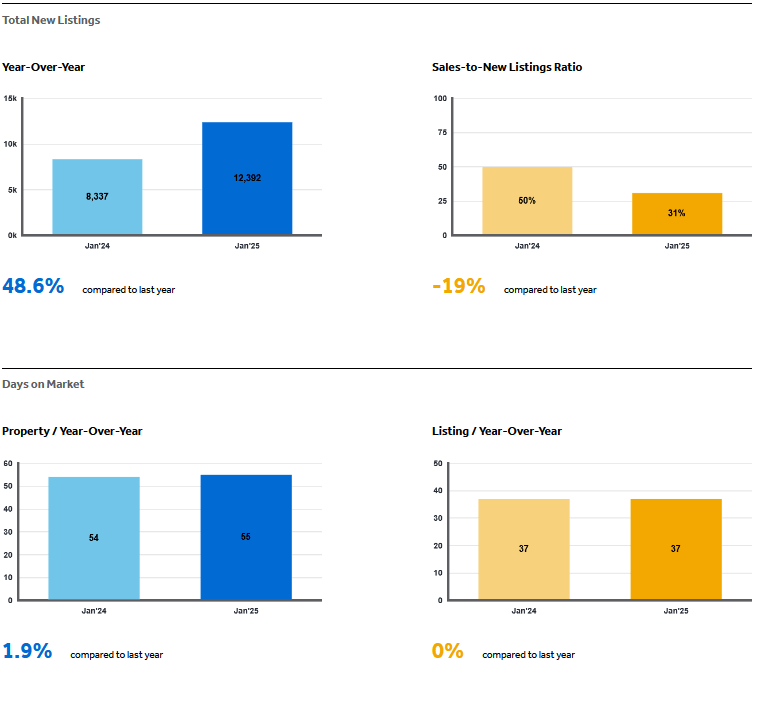

January 2025 Market Performance

The year kicked off with mixed results, as GTA REALTORS® reported:

- 3,847 home sales in January, down 7.9% year-over-year from January 2024.

- 12,392 new listings, up 48.6% year-over-year, indicating a growing supply of homes.

- MLS® Home Price Index Composite Benchmark up 0.44% year-over-year.

- Average home price reached $1,040,994, increasing 1.5% from January 2024.

Market Trend Insights

- More listings, more choices – The significant increase in new listings means buyers have more options, reducing the likelihood of excessive bidding wars.

- Price growth remains moderate – Unlike past years of double-digit price increases, the current market reflects a sustainable and predictable price appreciation.

- Seasonal momentum – While sales were down year-over-year, there was a slight month-over-month increase from December 2024, indicating a positive trend heading into the spring market.

What Does This Mean for Buyers and Sellers?

- For Buyers: With more supply in the market and mortgage rates expected to decline, 2025 could be a great time to enter the market. However, competition in certain housing segments (such as single-family homes) may still drive up prices.

- For Sellers: While demand is expected to rise, pricing competitively and ensuring a strong marketing strategy will be crucial in attracting buyers in a more balanced market.

Final Thoughts

The GTA housing market in 2025 is set for stable growth, driven by lower borrowing costs and increased housing supply. However, economic uncertainties and affordability challenges will continue to play a role in market dynamics. Buyers and sellers alike should stay informed and work with experienced REALTORS® to navigate the evolving landscape.

Are you looking to buy or sell in 2025? Reach out today to discuss your options and make the most of the opportunities this market has to offer.

Have feedback or questions? Please drop an email to Opel Ou, Real Estate Broker: opel@opelou.com

#GTARealEstate #TorontoHousingMarket #HomeSales #RealEstateTrends #HousingMarketUpdate #HomePrices #MarketRecovery #RealEstateNews #BuyersMarket #SellersMarket #InterestRates #TRREB #RealEstateInsights #RentalMarket #MortgageRates #CondoMarket #DetachedHomes #FirstTimeBuyers #RealEstateBlog #MarketUpdate #HomeBuying #HomeSelling #GTAHousing #TorontoRealEstate #BankOfCanada #PropertyInvestment #RealEstateBroker #Realtor #OpelOu

Source: TRREB – Market Watch

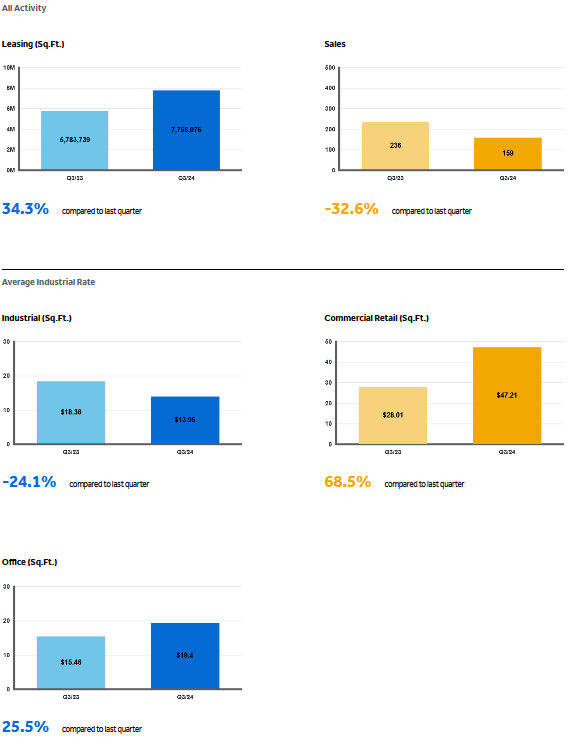

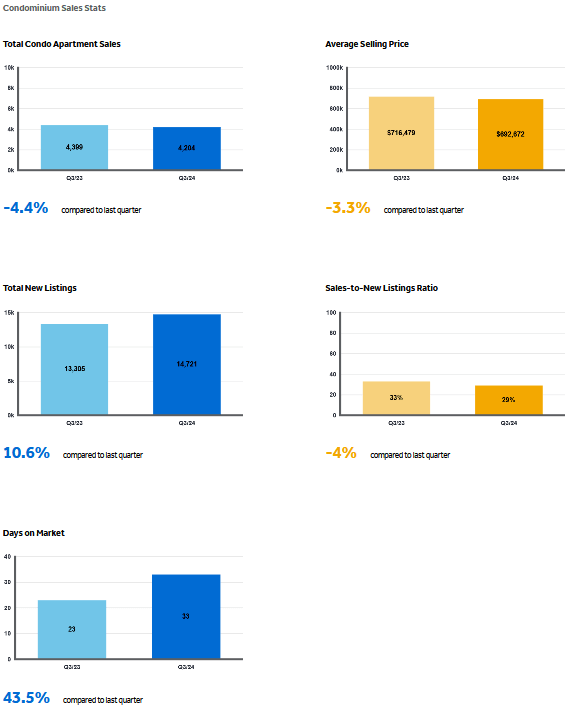

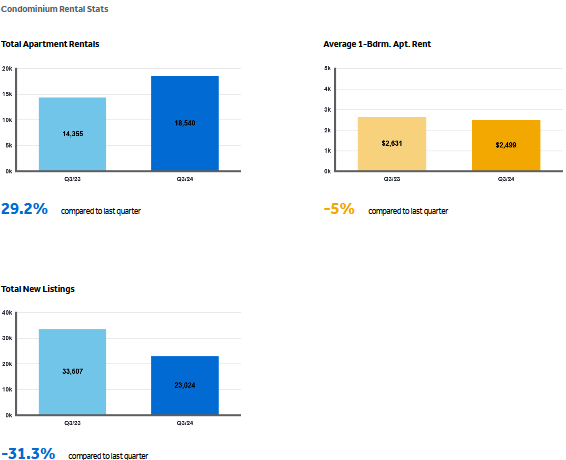

January 2025 – Market Statistics – Quick Overview

Residential Statistics

Commercial Statistics(Q3 2024)

Condominium Sales Statistics(Q3 2024)

Condominium Rental Statistics(Q3 2024)

* **In conjunction with TRREB’s redistricting project, historical data may be subject to revision moving forward. This could temporarily impact per cent change comparisons to data from previous years**

Source: Housing Market Chart Archive – The Toronto Regional Real Estate Board (TRREB)